找你的副驾驶

Create Chatbot For Banking

Transform Banking Experience with AI-Powered Chatbots Empower Customers 24/7 with Personalized Support, Maximize Efficiency and Security with Copilot.Live Banking Chatbots

Create Chatbot For Banking

Transform Banking Experience with AI-Powered Chatbots Empower Customers 24/7 with Personalized Support, Maximize Efficiency and Security with Copilot.Live Banking Chatbots

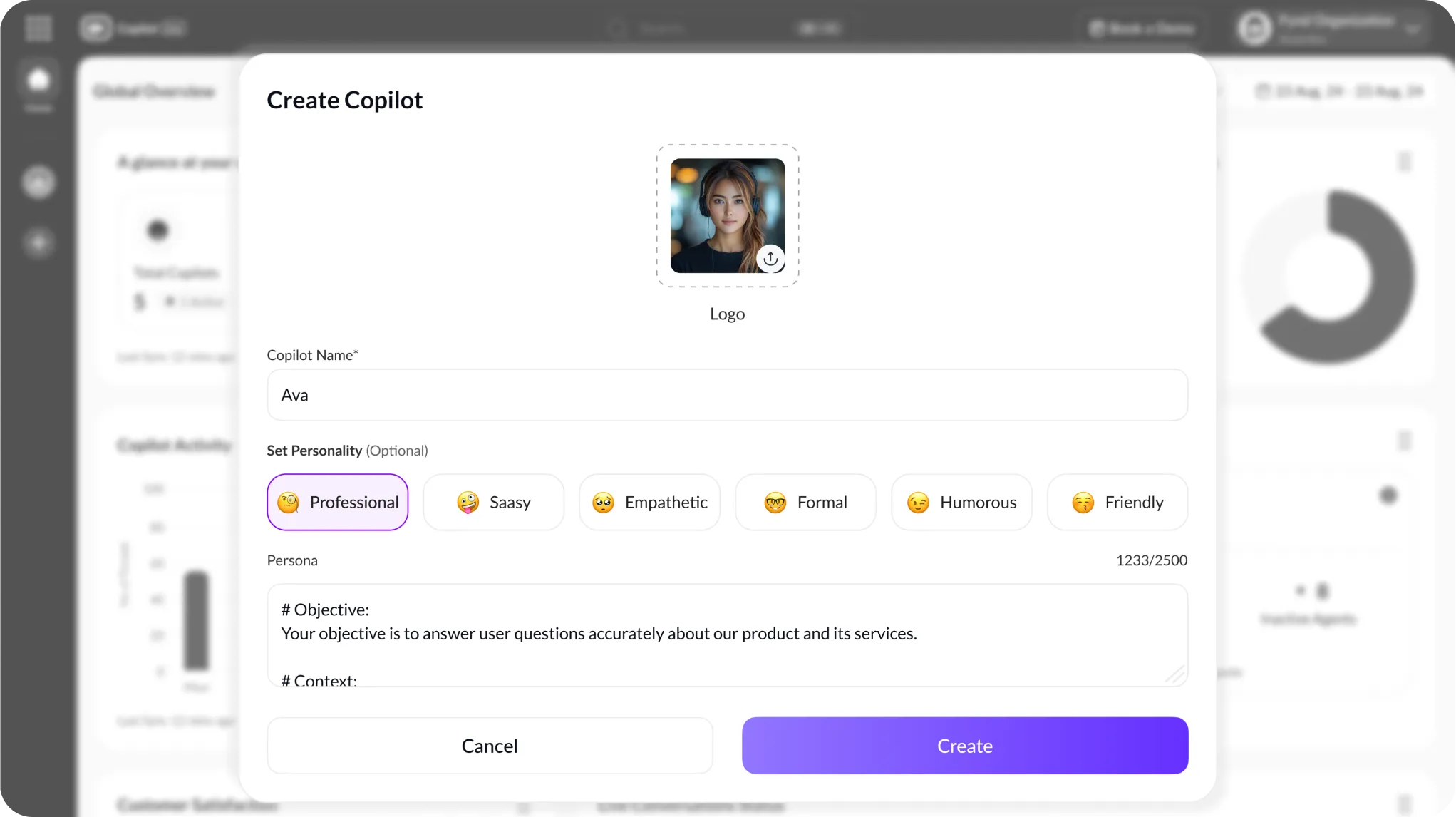

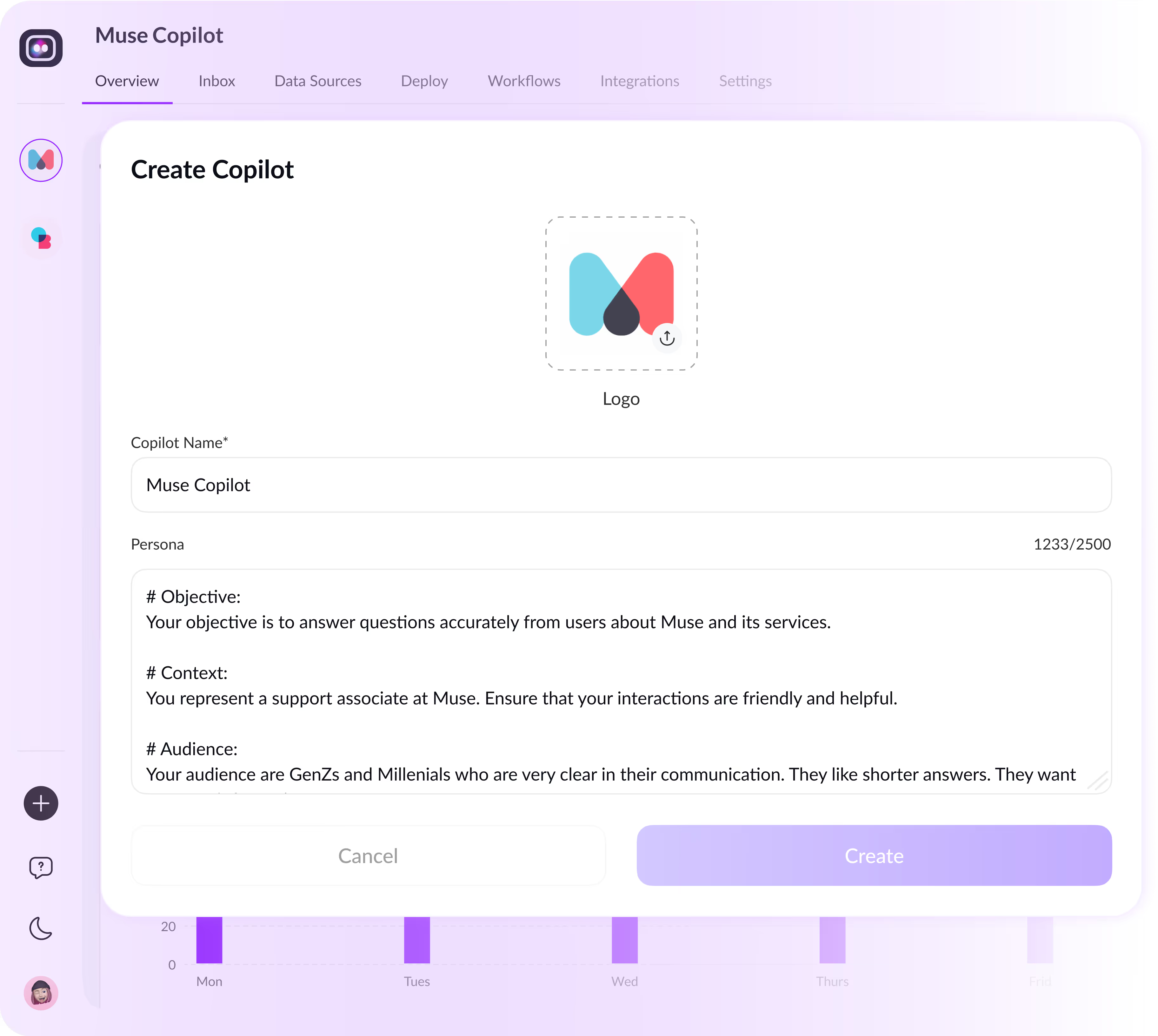

Build an AI Agent in 3 Steps

Build Your Banking Chatbot Effortlessly With Copilot.Live Simplified Process.

Define Objectives

Clearly outline your banking chatbot's intended purpose and goals, identifying the specific tasks it should perform and the problems it should solve for customers, ensuring alignment with your overall business objectives and customer service strategy.

Design Conversations

Create engaging dialogue flows for your chatbot, mapping out how it will interact with users to provide helpful responses and guide them through various banking tasks. Consider user input variations and incorporate natural language understanding to ensure smooth and intuitive interactions.

Develop Bot

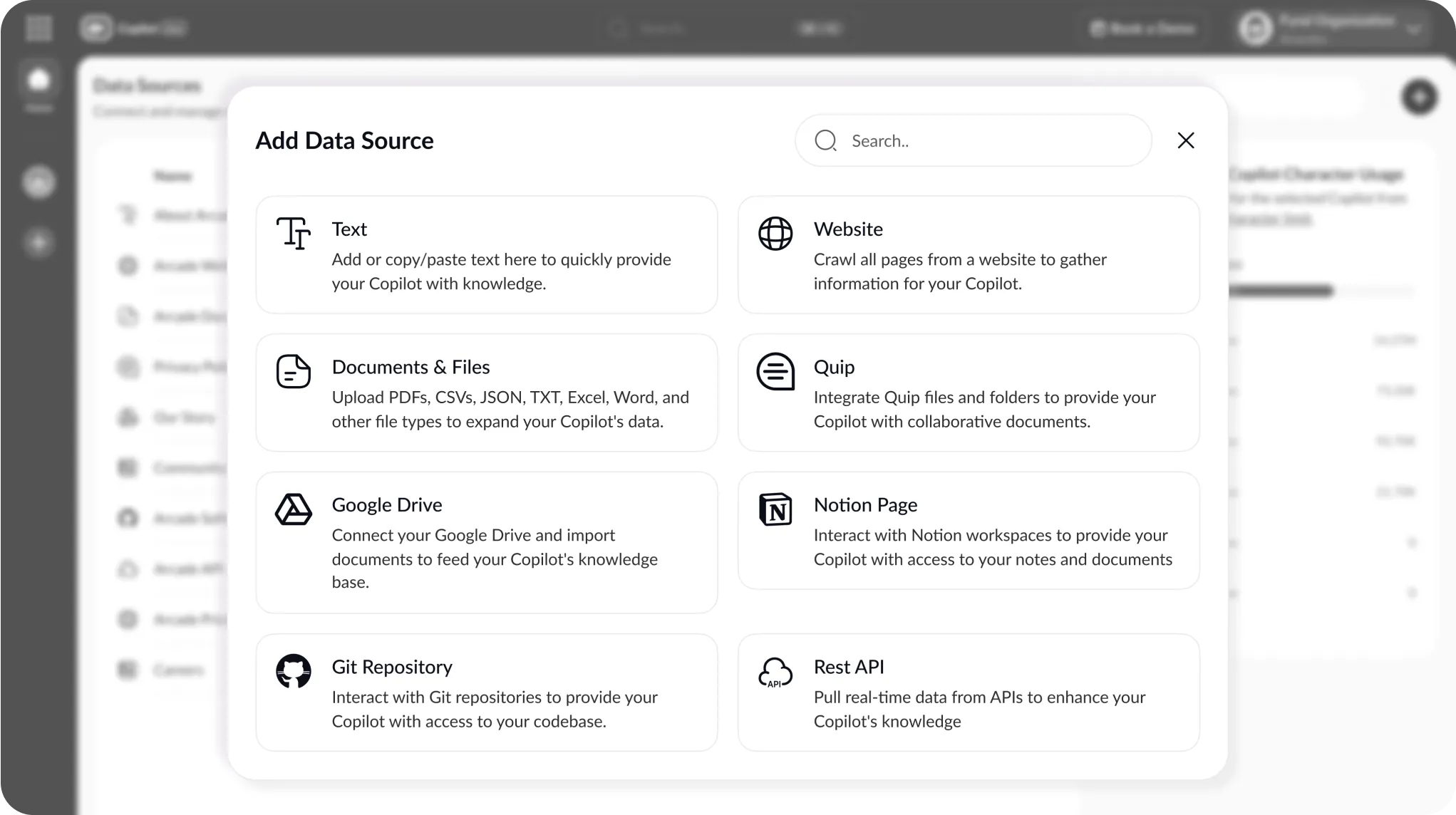

Utilize Copilot.Live intuitive platform to build your chatbot effortlessly, leveraging pre-built templates and drag-and-drop functionality to design conversation paths, integrate with backend systems, and customize the bot's appearance and voice to match your brand identity and user preferences.

Deploy And Monitor

Launch your chatbot seamlessly across your banking channels, such as websites, mobile apps, and messaging platforms, and continuously monitor its performance using Copilot.Live analytics tools. Track key metrics like user engagement, satisfaction, and task completion rates to identify areas for improvement and optimize the bot's effectiveness over time.

Revolutionizing Banking Services Unlocking Efficiency With Chatbot Solutions

In today's fast-paced digital era, banking institutions are increasingly turning to innovative technologies to meet their customers' evolving needs and expectations. As customers seek instant access to banking services and personalized support round the clock, chatbots have emerged as a transformative solution. This landing page delves into banking chatbots, exploring how they revolutionize customer service and streamline banking operations. From defining the essence of banking chatbots to elucidating their pivotal role in enhancing customer satisfaction, this page serves as a comprehensive guide for banking professionals and enthusiasts alike.

Discover the myriad benefits of integrating chatbot solutions into banking workflows, learn about best practices for implementation and ongoing management, and explore real-world use cases showcasing the versatility and effectiveness of these AI-driven assistants. Join us on a journey to unlock efficiency and elevate the banking experience with chatbot technology.

Why Choose Copilot.Live For Your Banking Chatbot Needs?

Industry Expertise

Copilot.Live specializes in providing tailored AI solutions for the banking sector. With a deep understanding of industry-specific challenges and requirements, we ensure that our chatbot technology meets the unique needs of financial institutions, providing optimal support to customers and enhancing operational efficiency.

Customization

Our platform offers extensive customization options, allowing you to personalize the chatbot's capabilities, responses, and user interface to align perfectly with your bank's branding, language, and customer service guidelines. This flexibility ensures that the chatbot integrates seamlessly with your existing systems and reflects your institution's identity.

Security And Compliance

Copilot.Live prioritizes data security and compliance with regulatory standards such as GDPR and ISO 27001. Our chatbot solutions are designed with robust security features to safeguard customer interactions, ensuring confidentiality and protecting sensitive financial information from unauthorized access or breaches.

Advanced Features

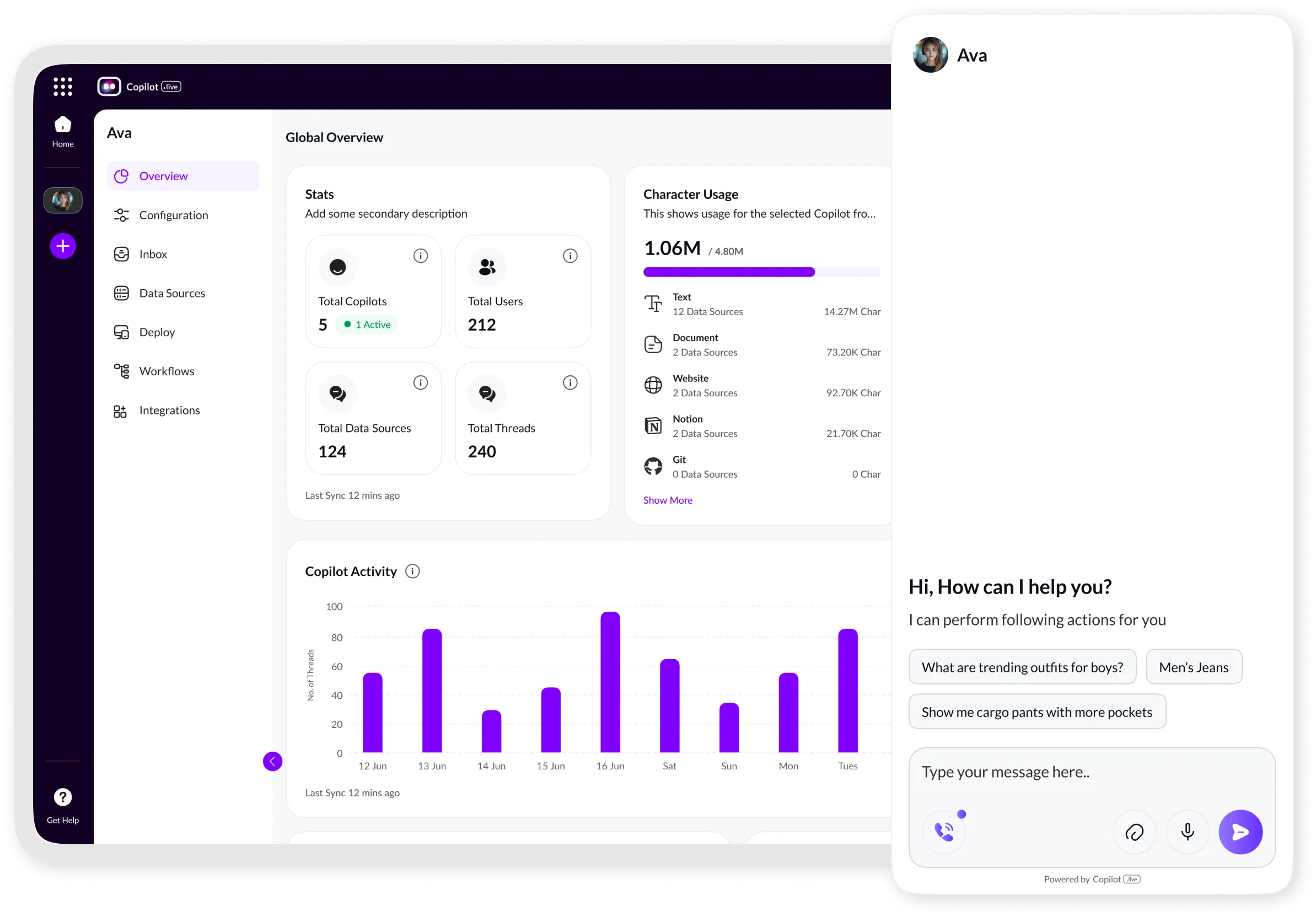

With Copilot.Live, you gain access to various advanced features including multichannel support, real-time analytics, and seamless integration with your bank's existing systems such as CRM and knowledge bases. These features empower your chatbot to deliver superior customer experiences, drive operational efficiency, and provide valuable insights for continuous improvement.

Revolutionize Business Operations With Chatbots

Step into the future of business efficiency with Chatbots for Business. In today's dynamic market environment, businesses strive for innovative solutions to enhance customer experience and streamline operations. Our platform offers cutting-edge chatbot technology, empowering businesses across various industries to automate tasks, engage customers, and drive growth. With customizable features and seamless integration, Chatbots for Business delivers tailored solutions to meet your organization's specific needs.

Join the forefront of digital transformation and harness the power of chatbots to revolutionize your business operations. Whether improving customer support, optimizing sales processes, or automating repetitive tasks, our chatbot platform provides the tools you need to stay ahead in a competitive landscape. Experience the future of business interaction with Chatbots for Business.

Key Features & Benefits Of Copilot.Live Chatbot For Banking

Unlock the potential of seamless banking experiences with Copilot.Live Chatbot. Our cutting-edge platform offers a range of features and benefits tailored to meet the unique needs of the banking sector.

Advanced Security Protocols

Copilot.Live Chatbot prioritizes the security of sensitive customer data by implementing cutting-edge security measures such as end-to-end encryption and multi-tier data security models. These protocols ensure that all interactions and information exchanged through the chatbot remain confidential and protected from potential cyber threats or breaches, instilling trust and confidence in customers regarding the safety of their financial information.

Seamless Integration

Our platform offers seamless integration with existing banking systems, including Customer Relationship Management (CRM) software and knowledge bases. This integration facilitates smooth data flow and communication between different systems, enabling banks to centralize customer information and streamline processes. By providing a unified interface for accessing and managing data, Copilot.Live Chatbot enhances operational efficiency and enables a consistent and cohesive user experience across various channels.

Behavioral Data Analytics

Copilot.Live Chatbot collects and analyzes behavioral data from customer interactions, including conversation patterns, preferences, and sentiment. By leveraging advanced analytics capabilities, banks can gain valuable insights into customer behavior, identify trends, and anticipate their needs more effectively. This data-driven approach empowers banks to tailor their services and marketing strategies to meet customer expectations better, ultimately improving customer satisfaction and loyalty.

AI-Powered Learning

With AI and machine learning algorithms, our chatbot continuously learns and improves its capabilities based on real-time customer interactions. By analyzing conversation data and user feedback, the chatbot can adapt its responses, refine its decision-making processes, and personalize interactions to serve better individual customer needs. This adaptive learning mechanism ensures that the chatbot remains up-to-date with evolving customer preferences and industry trends, enhancing its effectiveness and value over time.

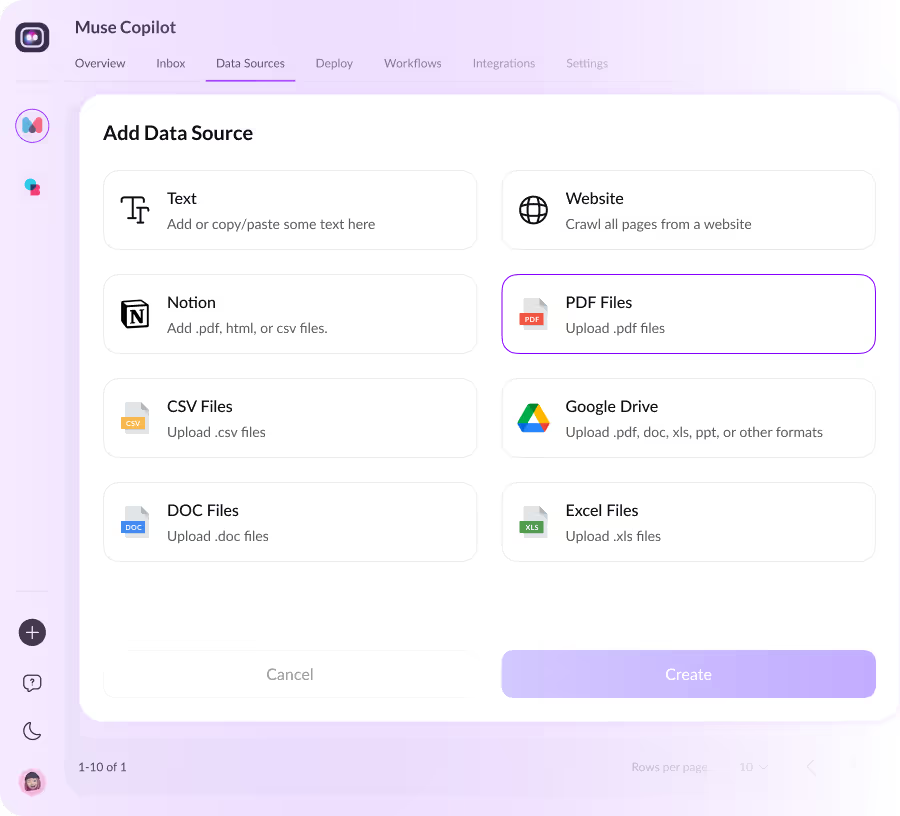

Launch Your AI-Powered Chatbot For Banking In No Time

Customizable Chatbot Templates

Copilot.Live offers customizable chatbot templates explicitly tailored for banking needs. These templates serve as a foundation, allowing banks to quickly deploy chatbots without starting from scratch. With customizable elements such as branding, tone, and functionality, banks can ensure that the chatbot aligns with their unique requirements and enhances the customer experience. This feature streamlines the implementation process while maintaining flexibility for further customization as needed, empowering banks to deliver personalized and efficient service.

Real-Time Customer Support

Copilot.Live provides real-time customer support, enabling banks to offer immediate assistance to their clients. This feature ensures that customers can access help whenever needed, enhancing their overall experience with the bank. Whether addressing inquiries, resolving issues, or providing guidance, real-time support fosters customer trust and satisfaction, leading to improved loyalty and retention. Additionally, it allows banks to stay responsive to changing customer needs and market dynamics, positioning them as reliable partners in their clients' financial journeys.

Multi-Channel Accessibility

With multi-channel accessibility, Copilot.Live enables banks to reach customers across various platforms, including smartphones, web browsers, and messaging apps. This feature ensures customers can interact with the bank through their preferred channels, enhancing convenience and accessibility. Banks can engage with customers seamlessly via mobile apps, websites, or messaging platforms like WhatsApp, providing consistent support and services across different touchpoints. This approach allows banks to meet customers where they are, catering to their diverse preferences and ensuring a superior banking experience.

Natural Language Processing (NLP)

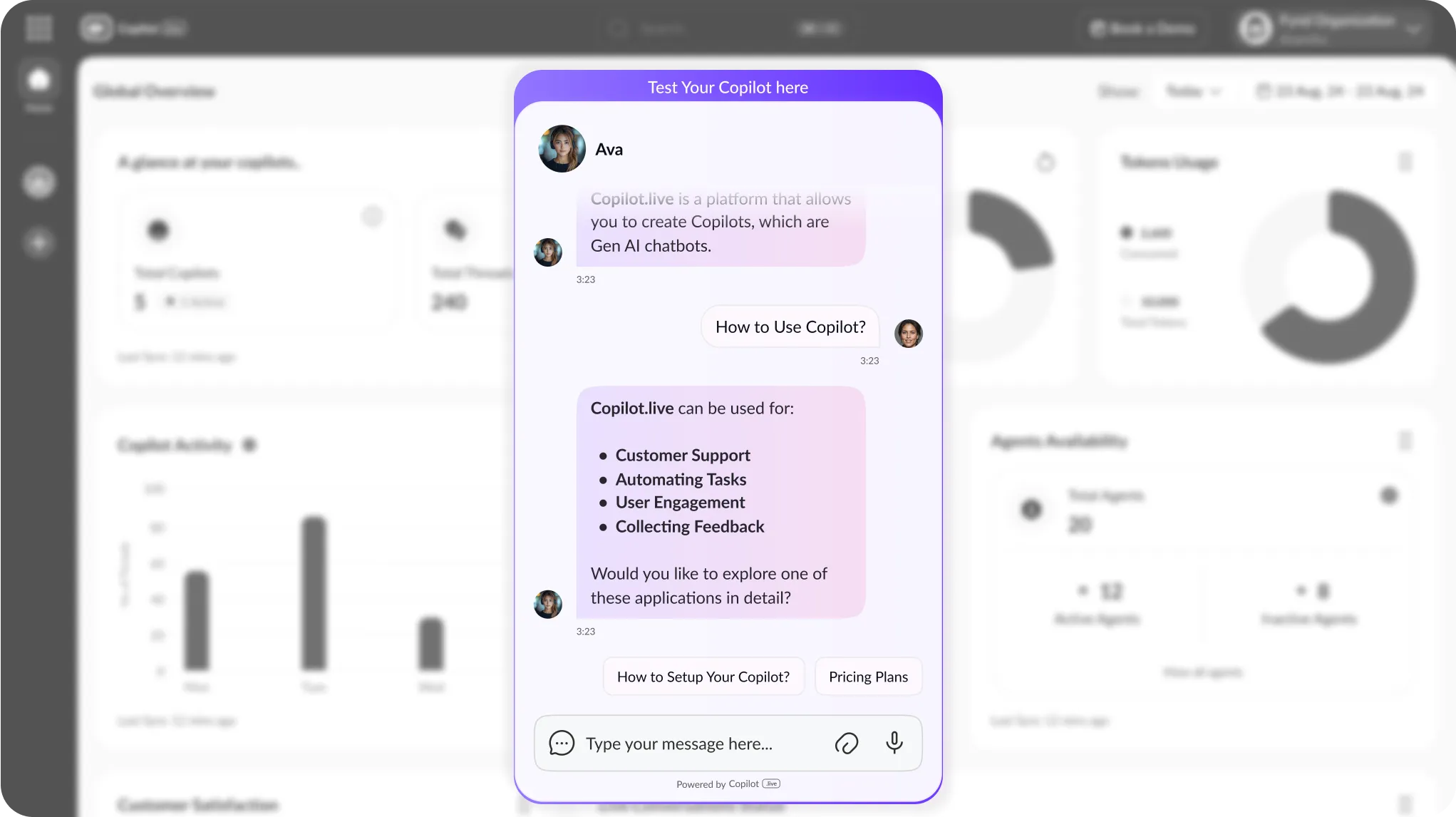

Natural Language Processing (NLP) is a crucial feature of Copilot.Live that enables the chatbot to understand and interpret human language in a way that mimics human comprehension. By leveraging NLP algorithms, the chatbot can analyze and derive meaning from user inputs, allowing for more natural and conversational interactions. This capability empowers the chatbot to handle a wide range of queries and requests, regardless of how they are phrased or articulated by users. Furthermore, NLP enables the chatbot to continuously learn and improve its language understanding capabilities, ensuring more effective communication and user interaction.

Transaction Support

Transaction support is a crucial feature offered by Copilot.Live, enabling the chatbot to assist users with various banking transactions seamlessly. Whether users need to transfer funds between accounts, make bill payments, or inquire about transaction history, the chatbot can facilitate these tasks efficiently. The chatbot enhances user convenience and satisfaction by guiding users through the transaction process and providing relevant information, such as account balances and transaction confirmations. Moreover, transaction support extends to personalized recommendations for financial products or services based on users' transaction patterns and preferences, enabling proactive engagement and driving business growth.

Personalized Recommendations

Personalized recommendations are a standout feature of Copilot.Live, allowing the chatbot to offer tailored suggestions for financial products and services based on each user's unique needs and preferences. By analyzing user interactions, transaction history, and demographic information, the chatbot can identify relevant offerings, such as savings accounts, credit cards, or investment options. These personalized recommendations help users make informed financial decisions and foster a deeper level of engagement and satisfaction with the banking experience. With personalized recommendations, users can discover new opportunities to optimize their finances and achieve their goals, driving long-term loyalty and retention for the bank. With personalized recommendations, users can discover new opportunities to optimize their finances and achieve their goals, driving long-term loyalty and retention for the bank.

Interactive Financial Tools

Copilot.Live offers interactive financial tools that empower users to control their finances easily. These tools enable users to perform various tasks directly within the chatbot interface, such as budgeting, goal setting, and financial planning. Users can access many intuitive tools to simplify complex financial processes from calculating loan payments to simulating investment returns. With interactive charts, calculators, and simulations, users can gain valuable insights into their financial health and make informed decisions about their money. These tools foster financial literacy and empowerment among users, helping them to achieve their financial goals more effectively.

Compliance And Security Features

Copilot.Live prioritizes compliance and security features to ensure the safety and confidentiality of user data. With robust encryption protocols and adherence to industry standards such as GDPR, ISO 27001, and Copilot.Live safeguards sensitive information against unauthorized access or breaches. Compliance features include audit trails, access controls, and data encryption to meet regulatory requirements and protect user privacy. Additionally, Copilot.Live implements advanced security measures, such as multi-tier data security models and end-to-end encryption, to maintain the integrity of user interactions and prevent data tampering or interception.

Automated Appointment Scheduling

Copilot.Live offers automated appointment scheduling functionality, streamlining the process for customers and bank representatives. Through intuitive chatbot interactions, users can easily schedule appointments for various banking services, such as account consultations, loan applications, or financial advice sessions. The chatbot efficiently manages appointment booking, eliminating the need for manual intervention and reducing administrative overhead for bank staff. Users can specify their preferred date, time, and service type, and the chatbot intelligently coordinates with the bank's calendar system to find available slots and confirm appointments seamlessly.

Integration With Banking Systems

Copilot.Live seamlessly integrates with existing banking systems, ensuring a smooth and efficient workflow for customers and bank staff. The chatbot connects with core banking platforms, customer relationship management (CRM) software, and other relevant systems through robust APIs and middleware solutions. This integration enables the chatbot to access real-time customer data, transaction histories, account information, and product details, providing personalized and contextually relevant responses to user queries. By leveraging data from banking systems, Copilot.Live can offer tailored recommendations, process transactions, and address customer inquiries with accuracy and speed.

Sentiment Analysis

Copilot.Live incorporates sentiment analysis capabilities to gauge and interpret the emotions expressed by banking customers during interactions. By analyzing the text input, the chatbot can identify sentiments such as satisfaction, frustration, confusion, or urgency, allowing it to tailor responses accordingly. Sentiment analysis enables Copilot.Live to understand the underlying tone of customer messages and respond with empathy and relevance, enhancing the overall user experience. Positive sentiments may trigger personalized acknowledgments or offers of assistance, while negative sentiments prompt the chatbot to address concerns proactively and escalate issues to human agents if necessary

Multi-Language Support

Copilot.Live offers multi-language support, allowing banks to engage with customers in their preferred language across diverse markets and regions. With this feature, the chatbot can understand and respond to inquiries in multiple languages, enhancing accessibility and user experience for customers from different linguistic backgrounds. Whether customers communicate in English, Spanish, French, Mandarin, or any other supported language, Copilot.Live ensures seamless interaction by accurately interpreting queries and responding in the corresponding language. This capability enables banks to cater to a global audience, expand their reach, and facilitate communication with customers worldwide.

Continuous Learning And Improvement

Copilot.Live incorporates continuous learning and improvement mechanisms, allowing the chatbot to enhance its performance over time. Through machine learning algorithms and data analysis, the chatbot iteratively learns from customer interactions, identifies patterns, and refines its responses to better meet user needs. By analyzing conversation transcripts and user feedback, Copilot.Live identifies areas for improvement and adjusts its algorithms accordingly, ensuring that it evolves and adapts to changing customer preferences and requirements. This ongoing learning process enables the chatbot to become increasingly proficient in understanding user queries, providing accurate responses, and resolving issues effectively

Comprehensive Analytics And Reporting

Copilot.Live offers comprehensive analytics and reporting capabilities, allowing banks to gain valuable insights into chatbot performance and customer interactions. The platform provides detailed metrics and reports on various aspects of chatbot usage, including conversation volume, user engagement, response times, and conversation outcomes. By analyzing this data, banks can evaluate their chatbot deployment's effectiveness, identify improvement areas, and make informed decisions to optimize the chatbot's performance.

Additionally, Copilot.Live analytics feature enables banks to track key performance indicators (KPIs) related to customer satisfaction, such as customer feedback ratings and sentiment analysis..

Scalability And Flexibility

Copilot.Live provides scalability and flexibility, allowing banks to quickly scale their chatbot deployment to accommodate growing customer demand and changing business requirements. The platform is designed to handle extensive conversations efficiently, ensuring seamless performance even during peak usage periods.

With Copilot.Live, banks can quickly adapt their chatbot to evolving business needs by customizing its functionality, adding new features, or integrating with other systems and services. The platform offers a flexible architecture that supports easy customization and integration, enabling banks to tailor the chatbot to their specific requirements

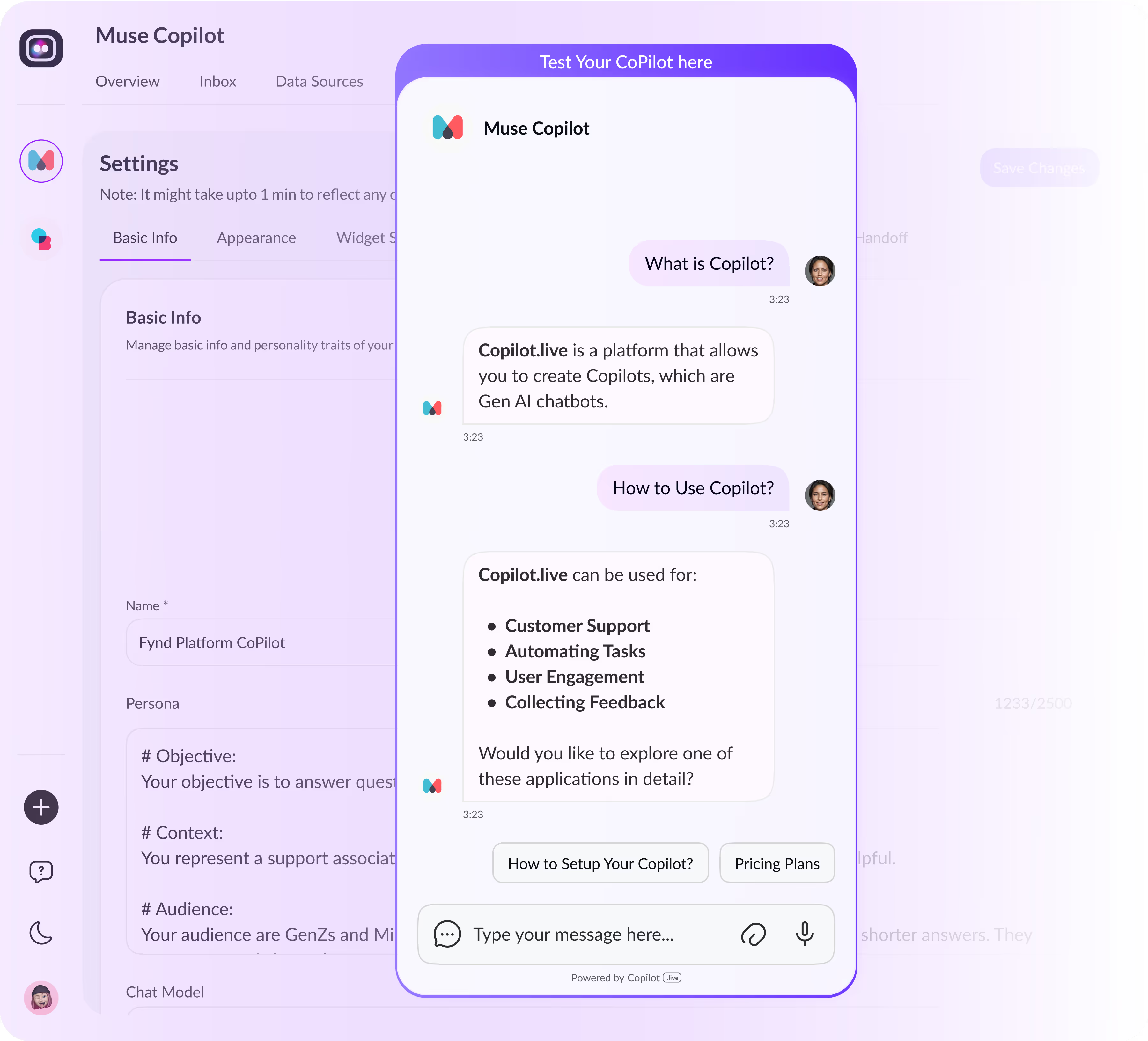

Transform Your Banking Experience With Copilot.Live Chatbots

Discover the future of banking with Copilot.Live chatbots. Our innovative platform revolutionizes how banks interact with customers, offering personalized, efficient, and secure solutions to meet modern banking needs with Copilot.Live, banks can enhance customer satisfaction, streamline operations, and drive business growth. Our chatbots leverage cutting-edge technology such as natural language processing (NLP), machine learning, and real-time analytics to deliver seamless customer experiences across multiple channels.

Whether it's answering common queries, providing personalized recommendations, or assisting with complex transactions, our chatbots are designed to exceed customer expectations at every touchpoint. Experience the power of AI-driven chatbots and unlock new opportunities for your bank. Join the ranks of leading financial institutions that trust Copilot.Live to deliver exceptional customer service and drive digital transformation in the banking industry. Transform your banking experience with Copilot.Live chatbots today.

What Does A Banking Chatbot Need To Know?

Chatbots need to be equipped with a wide range of knowledge and capabilities to serve customers in the banking sector These AI-powered assistants must deeply understand banking processes, products, and regulations, from basic account inquiries to complex financial transactions. They need to be able to handle inquiries related to account balances, transaction histories, loan applications, and more, all while ensuring data security and compliance with industry standards.

Furthermore, banking chatbots must be trained to interpret natural language inputs, recognize intent, and provide accurate responses in real time. They should also be able to integrate with existing banking systems, access customer data securely, and escalate queries to human agents when necessary. By equipping chatbots with the proper knowledge and functionalities, banks can enhance customer satisfaction, streamline operations, and drive digital engagement in today's competitive banking landscape.

经常问的问题

如果有任何疑问、反馈或建议,您可以通过与我们联系,或阅读下文。

A. A banking chatbot uses artificial intelligence and natural language processing to understand customer queries and provide relevant responses, simulating a conversation with a human agent.

A. Yes, banking chatbots are designed with robust security features to ensure the confidentiality and integrity of customer data, complying with industry regulations like GDPR and ISO 27001.

A. You can perform a variety of transactions, including checking account balances, transferring funds between accounts, paying bills, applying for loans or credit cards, and more, depending on the chatbot's capabilities.

A. Banking chatbots prioritize security and encryption to protect customer information. They undergo regular security audits and comply with industry standards to maintain a secure user environment.

A. Advanced banking chatbots utilize machine learning algorithms to analyze customer data and provide personalized recommendations for financial products and services tailored to individual needs and preferences.

A. Banking chatbots are accessible through various channels, including banking websites, mobile apps, messaging platforms, and virtual assistants like Amazon Alexa or Google Assistant.

A. Absolutely, banking chatbots are equipped to handle various account-related inquiries, such as account balances, transaction history, statement requests, account closures, and more.

A. Banking chatbots are designed to provide instant responses to customer queries, significantly reducing response times compared to traditional customer support channels like phone or email.

A. Yes, banking chatbots offer seamless escalation options, allowing customers to transition to human agents if their query requires further assistance or cannot be resolved automatically.

A. Yes, most banking chatbots operate 24/7, providing round-the-clock assistance to customers for account inquiries, transaction support, and other banking-related tasks.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)