รับนักบินของคุณ

Create Chatbot For Wealth Management

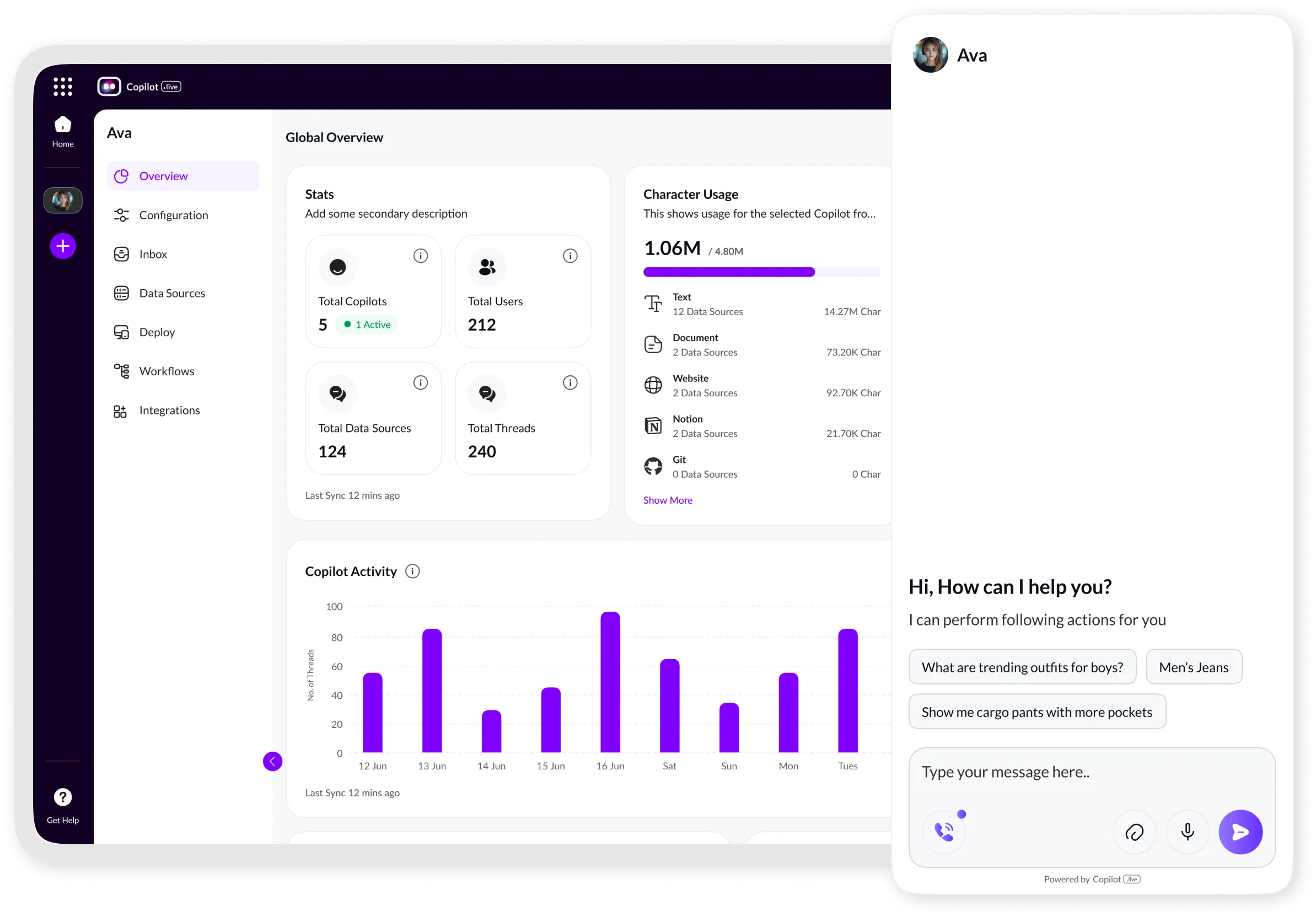

Discover how Copilot.Live revolutionizes wealth management with cutting-edge AI-powered chatbots. Enhance client interactions, streamline operations, and deliver personalized financial advice seamlessly. Elevate your services with our innovative chatbot solutions tailored to the complexities of modern wealth management.

Create Chatbot For Wealth Management

Discover how Copilot.Live revolutionizes wealth management with cutting-edge AI-powered chatbots. Enhance client interactions, streamline operations, and deliver personalized financial advice seamlessly. Elevate your services with our innovative chatbot solutions tailored to the complexities of modern wealth management.

Build an AI assistant in 3 minutes

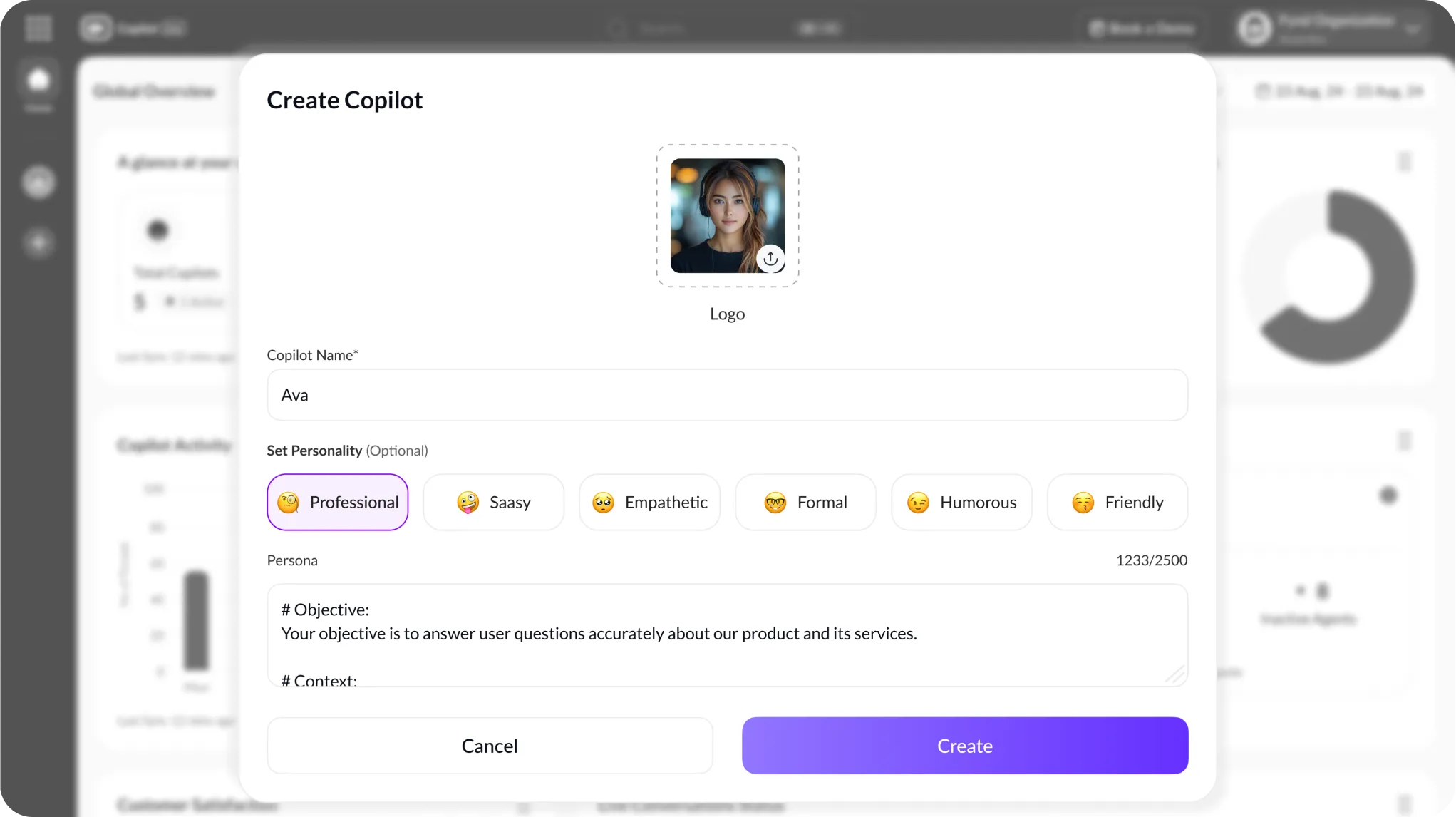

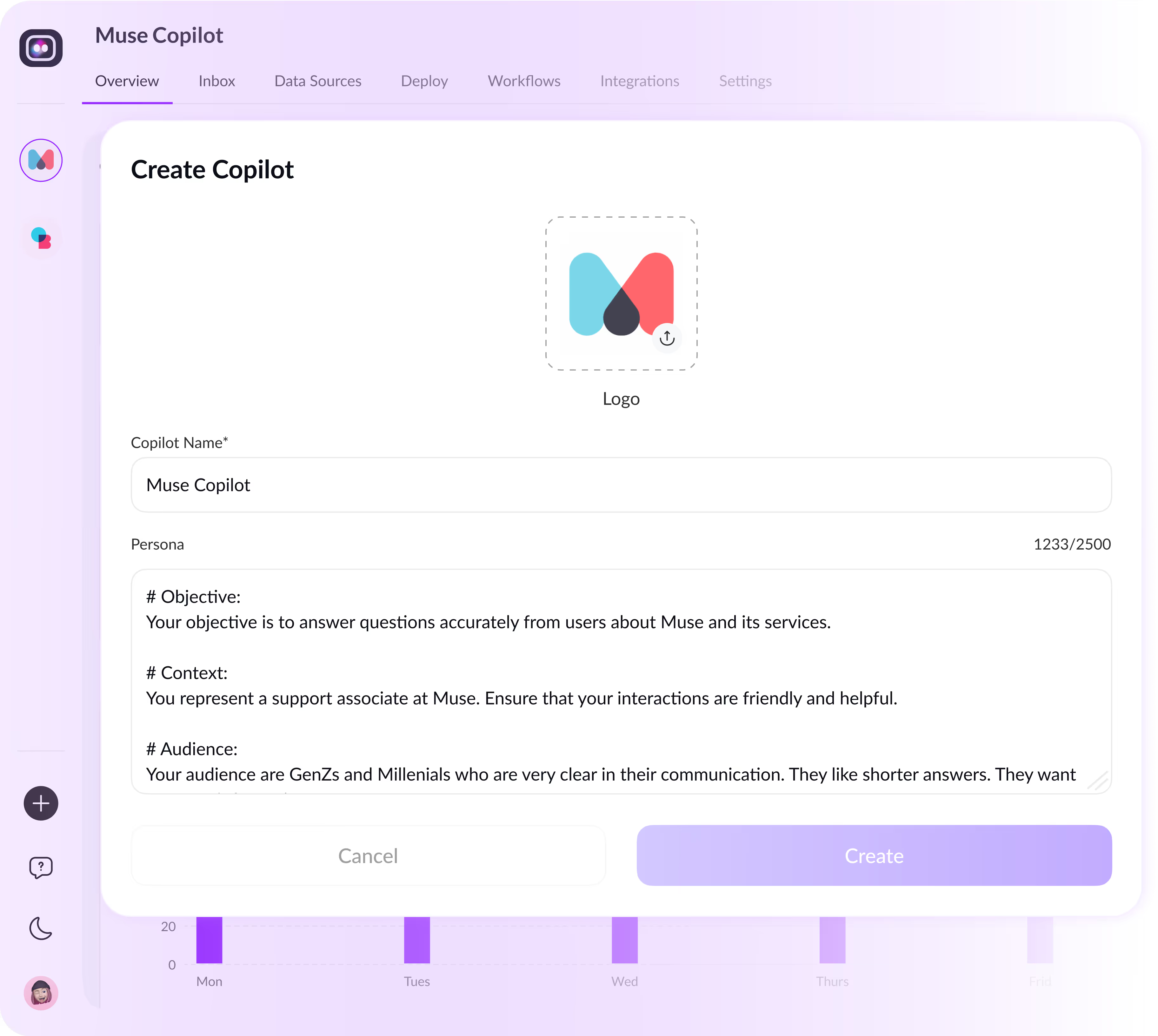

Creating The Chatbot For Wealth Management With Copilot.Live

Sign Up At Copilot.Live

Register and access our intuitive platform designed for creating sophisticated chatbots tailored to wealth management needs.

Create The Persona

Define your chatbot's personality, tone, and interaction style to align with your wealth management brand and client expectations.

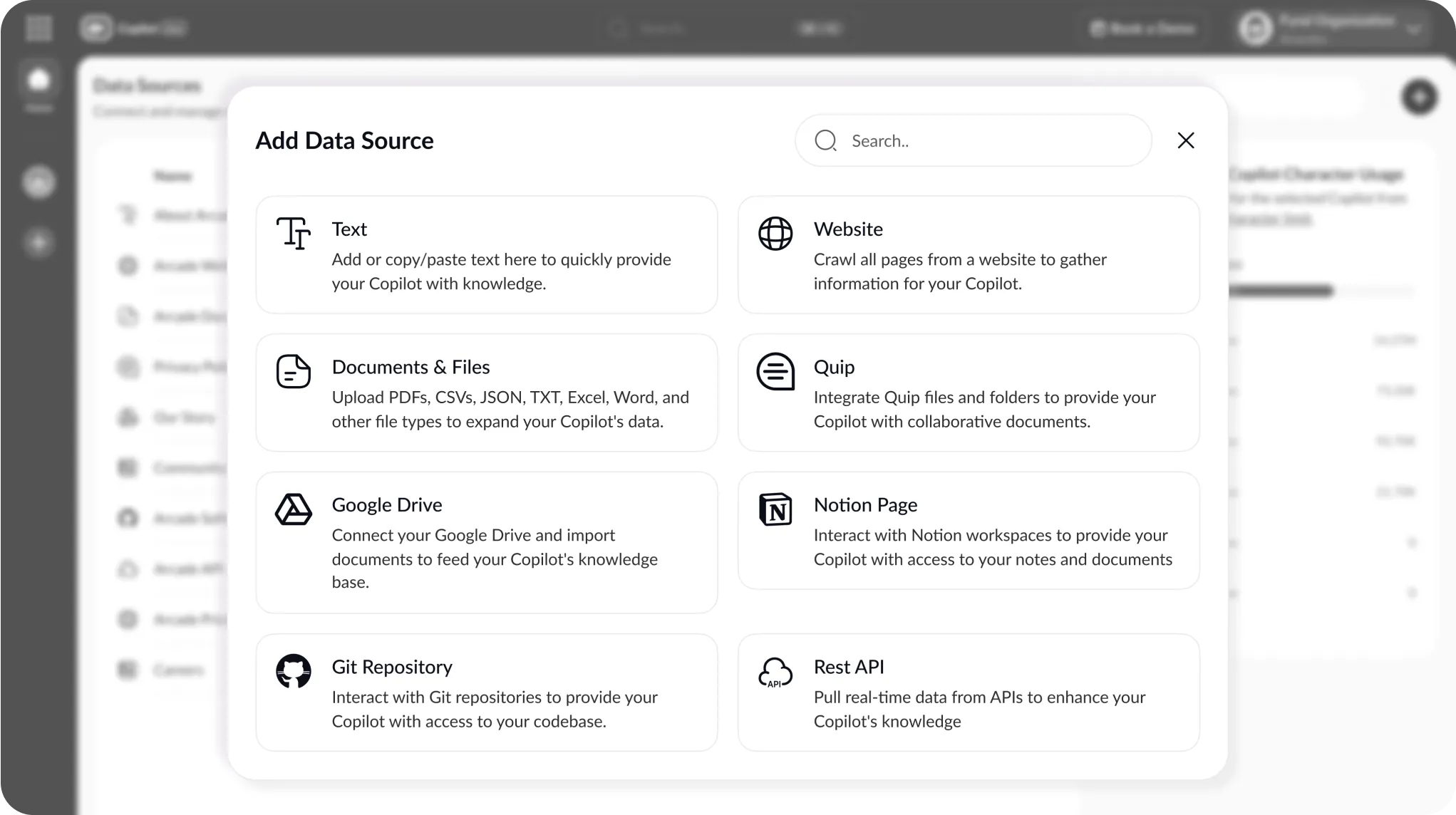

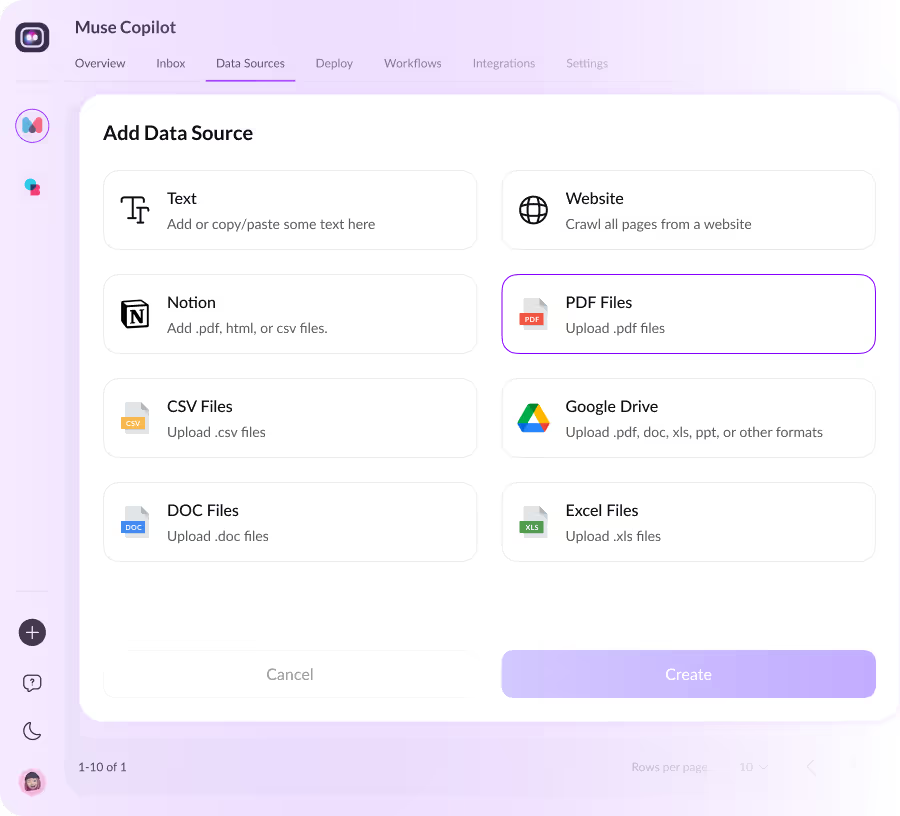

Enter The URL Of The Website Or The Tool Which You Are Looking For

Integrate data sources and APIs seamlessly to provide real-time financial insights and personalized recommendations.

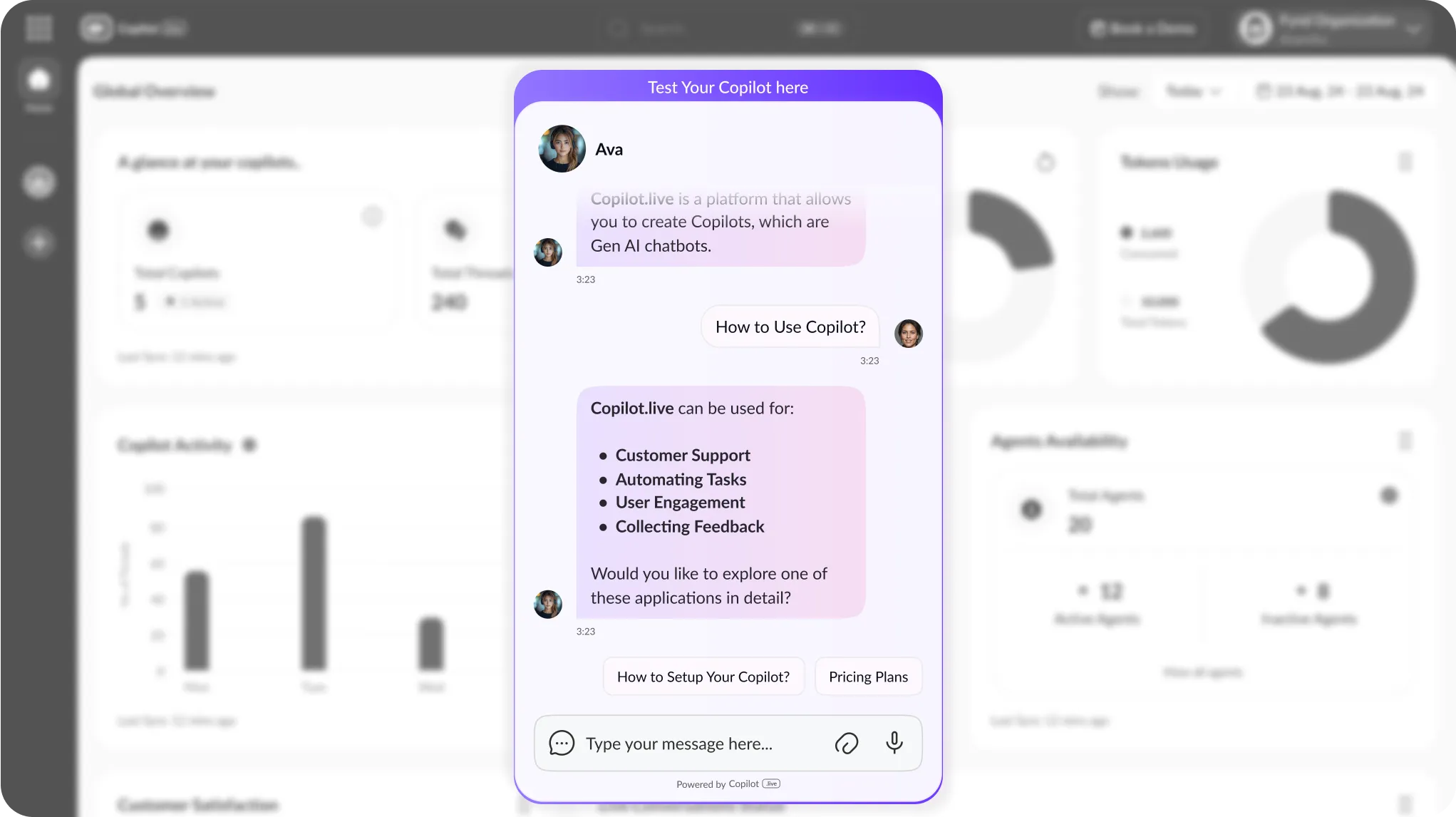

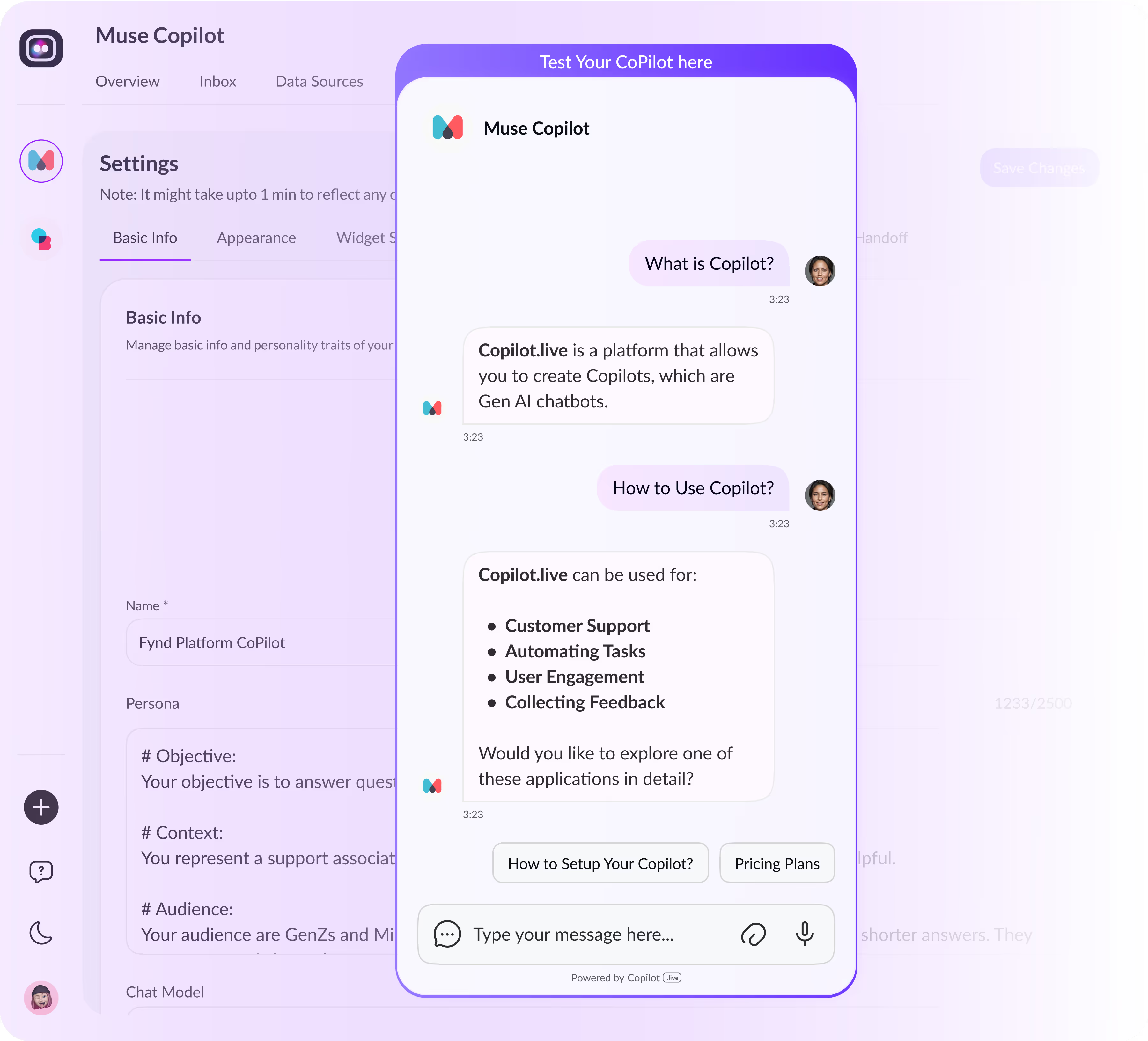

ทดสอบและปรับใช้

Ensure your chatbot functions flawlessly across platforms and deploy it to engage clients effectively, enhancing their wealth management experience.

Transforming Wealth Management With AI-Powered Chatbots

In today's competitive financial landscape, integrating AI-powered chatbots into your wealth management strategy can redefine client engagement and operational efficiency. With Copilot.Live, harness the potential of AI chatbots in just a few straightforward steps. Imagine offering clients a virtual assistant available 24/7 to handle inquiries, provide personalized investment advice, and optimize portfolio management.

Whether it's automating routine transactions, analyzing market trends, or offering real-time financial insights, AI chatbots streamline operations and enhance client satisfaction. Explore how Copilot.Live empowers wealth management firms to deliver exceptional service, improve decision-making, and stay ahead in a rapidly evolving industry. Revolutionize your approach to client interactions and elevate your wealth management services with AI-driven innovation.

Why Choose Copilot.Live For Your Wealth Management Chatbot Needs?

Advanced AI Capabilities

Copilot.Live integrates cutting-edge AI technologies to offer robust chatbot solutions for wealth management. From personalized client interactions to real-time data analysis, our AI ensures superior performance and efficiency.

Tailored Financial Insights

Our chatbots deliver customized investment advice and portfolio management strategies based on client preferences and market trends, enhancing decision-making accuracy.

ความสามารถในการปรับขนาดและความยืดหยุ่น

Copilot.Live chatbots are scalable to handle varying client volumes effortlessly, ensuring seamless operations and adaptable responses to market changes.

มาตรการรักษาความปลอดภัยขั้นสูง

With built-in security protocols and compliance features, Copilot.Live prioritizes data privacy and protects sensitive client information, ensuring trust and reliability.

Transform Wealth Management With AI-Powered Chatbots

In today's dynamic financial landscape, integrating AI-powered chatbots into wealth management processes revolutionizes client interaction and operational efficiency. Copilot.Live offers state-of-the-art chatbot solutions tailored for financial advisors and institutions. These AI-driven assistants provide real-time insights, personalized investment recommendations, and seamless client engagement.

Imagine a virtual financial advisor available 24/7, capable of analyzing market trends, optimizing portfolios, and ensuring regulatory compliance with precision. Whether enhancing customer service, streamlining operations, or scaling business growth, Copilot.Live chatbots empower wealth management professionals to deliver superior service and build lasting client relationships. Embrace the future of wealth management with AI innovation discover how Copilot.Live can elevate your financial services today.

Key Features & Benefits Of Copilot.Live Chatbot For Your Wealth Management Industry

Unlock enhanced capabilities with Copilot.Live advanced chatbot designed specifically for the wealth management industry. Explore how these new features redefine portfolio analysis, ensure regulatory compliance, integrate seamlessly with existing systems, and leverage predictive analytics. Transform your wealth management operations with cutting-edge technology tailored to meet industry demands.

Advanced Portfolio Analysis

Conduct comprehensive analysis of client portfolios in real-time, offering insights into asset allocation, risk management, and performance optimization.

การปฏิบัติตามกฎระเบียบ

Ensure adherence to financial regulations with automated compliance checks and reporting, minimizing risks and enhancing governance.

ความสามารถในการบูรณาการ

Seamlessly integrate with existing CRM systems, financial databases, and reporting tools for a unified wealth management solution.

การวิเคราะห์เชิงคาดการณ์

Utilize AI-driven predictive analytics to forecast market trends, recommend investment strategies, and anticipate client needs, enhancing proactive client service and decision-making.

Launch Your AI-Powered Chatbot For Wealth Management Industry In No Time

Seamless Integration With Existing CRM Systems

Seamless integration with existing CRM systems is a crucial feature of Copilot.Live for wealth management. This capability allows for effortless synchronization of customer data across platforms, ensuring a unified view of client interactions and preferences. By integrating with CRM systems, Copilot.Live enhances efficiency by eliminating data silos, streamlining workflows, and enabling personalized customer engagements. Financial advisors can leverage this integration to access comprehensive client profiles, track interactions seamlessly, and deliver tailored financial advice effectively, thereby enhancing client satisfaction and operational effectiveness in wealth management processes.

Real-Time Portfolio Analysis And Recommendations

Real-time portfolio analysis and recommendations are essential features offered by Copilot.Live for wealth management. This capability enables financial advisors and clients to monitor investment portfolios continuously, analyzing performance metrics and identifying opportunities or risks promptly. By leveraging real-time data processing and analytics, Copilot.Live provides actionable insights, suggesting adjustments to asset allocations or investment strategies based on market conditions or client goals. This proactive approach enhances decision-making accuracy, optimizes portfolio performance, and ultimately helps clients achieve their financial objectives more effectively in a dynamic market environment.

การวิเคราะห์เชิงคาดการณ์สำหรับการตัดสินใจเชิงรุก

Predictive analytics with Copilot.Live empowers proactive decision-making in wealth management. By analyzing historical data and current market trends, Copilot.Live forecasts future outcomes and trends, helping financial advisors anticipate market movements and make informed decisions ahead of time. This capability not only enhances risk management by identifying potential threats early but also identifies opportunities for maximizing returns. By leveraging advanced algorithms and machine learning models, Copilot.Live provides actionable insights that drive strategic planning and ensure clients' investments are aligned with their long-term financial goals. This proactive approach helps in staying ahead in a competitive market landscape while delivering superior value to clients.

Compliance Monitoring And Reporting Tools

Copilot.Live offers robust compliance monitoring and reporting tools tailored for the wealth management industry. These tools ensure adherence to regulatory requirements by continuously monitoring activities and transactions. By leveraging advanced algorithms and real-time data processing, Copilot.Live detects anomalies and suspicious activities, flagging them for further investigation. This capability not only enhances transparency and trust but also mitigates compliance risks proactively. Integrated reporting features provide comprehensive insights into compliance status, aiding in audits and regulatory filings. With Copilot.Live, financial institutions can uphold regulatory standards effortlessly while focusing on delivering exceptional client service and maintaining operational integrity.

Personalized Investment Advice

Copilot.Live excels in delivering personalized investment advice, leveraging advanced AI algorithms to tailor recommendations based on individual investor profiles and financial goals. By analyzing client data, market trends, and risk preferences in real-time, Copilot.Live generates actionable insights that optimize portfolio performance and align investments with specific objectives. This personalized approach enhances client satisfaction and trust, empowering wealth managers to offer bespoke financial strategies. Whether adjusting asset allocations, suggesting new investment opportunities, or forecasting market trends, Copilot.Live ensures that each recommendation is relevant and beneficial, ultimately supporting clients in achieving their long-term financial aspirations with confidence.

24/7 Customer Support And Engagement

Copilot.Live provides 24/7 customer support and engagement, ensuring round-the-clock assistance for wealth management clients. Through AI-powered chatbots, clients can access instant responses to queries, receive guidance on financial decisions, and get updates on their portfolios anytime, anywhere. This continuous availability enhances client satisfaction by addressing concerns promptly and offering personalized interactions. Whether clients need assistance navigating the platform, understanding investment options, or monitoring their financial progress, Copilot.Live robust customer support capabilities ensure seamless engagement and support throughout their wealth management journey.

Multi-Channel Communication Capabilities

Copilot.Live offers multi-channel communication capabilities, allowing wealth management firms to engage clients across various digital touchpoints seamlessly. Whether through web portals, mobile apps, social media platforms, or email, clients can interact with AI-powered chatbots to inquire about their investments, receive updates, and seek personalized advice. This versatility ensures that clients can access information and support through their preferred channels, enhancing convenience and accessibility. Copilot.Live multi-channel communication capabilities enable consistent and efficient client engagement, fostering stronger relationships and improving overall satisfaction in wealth management services.

Customizable User Interface And Conversational Flows

Copilot.Live provides a customizable user interface (UI) and flexible conversational flows, empowering wealth management firms to tailor their chatbot interactions to specific client needs and preferences. With customizable UI, firms can match the chatbot's appearance and branding to maintain a seamless user experience across platforms. Moreover, adjustable conversational flows enable firms to personalize interactions based on client behaviors and queries, optimizing engagement and satisfaction. This flexibility not only enhances user experience but also allows firms to adapt quickly to evolving client expectations and industry trends, ensuring effective communication and service delivery through AI-powered solutions.

Automated Transaction Execution

Automated transaction execution with Copilot.Live streamlines the process of buying, selling, and managing investments for wealth management firms. This feature enables the chatbot to execute transactions based on predefined criteria and client instructions, ensuring timely and accurate processing without manual intervention. By automating these tasks, firms can reduce operational overhead, minimize errors, and improve efficiency in handling client portfolios. This capability not only enhances service delivery but also boosts client satisfaction by providing swift and precise execution of investment decisions through AI-driven automation.

Data Security And Privacy Controls

Data Security and Privacy Controls are integral features of Copilot.Live, ensuring robust protection for sensitive financial data. With encryption standards applied to all data transmissions and strict access controls in place, user information is safeguarded against unauthorized access. Our compliance framework adheres to global regulations like GDPR and CCPA, reinforcing our commitment to data privacy. Continuous monitoring and regular audits further enhance security, maintaining a secure environment for managing wealth management data effectively.

Scalable To Handle High Volumes Of Customer Interactions

Copilot.Live scalability ensures it can effortlessly manage high volumes of customer interactions in the wealth management sector. Leveraging advanced cloud infrastructure, our platform dynamically scales resources to meet demand spikes, ensuring seamless service delivery even during peak times. This capability allows financial firms to handle numerous client queries, transactions, and portfolio analyses efficiently without compromising performance or user experience, making Copilot.Live a reliable solution for scaling wealth management operations.

AI-Powered Fraud Detection And Prevention

Copilot.Live incorporates AI-powered fraud detection and prevention capabilities to safeguard wealth management operations effectively. By leveraging advanced machine learning algorithms, the platform continuously analyzes transactional data, identifying patterns indicative of fraudulent activities in real-time. This proactive approach enables early detection and mitigation of potential threats, ensuring that client assets and sensitive information remain secure. With Copilot.Live robust fraud detection tools, financial institutions can enhance trust, compliance, and operational resilience in managing wealth portfolios, providing peace of mind to both clients and stakeholders alike.

Natural Language Processing For Enhanced User Interaction

Copilot.Live integrates natural language processing (NLP) to enhance user interaction within wealth management contexts. This feature allows clients to communicate naturally with the chatbot, posing questions and receiving responses in a conversational manner. NLP enables the system to understand and interpret the meaning behind user queries, offering accurate and contextually relevant information promptly. By facilitating smoother interactions, Copilot.Live improves user satisfaction, streamlines information retrieval, and enhances overall user experience in managing financial portfolios efficiently and intuitively.

Performance Tracking And Reporting Features

Performance tracking and reporting are integral features of Copilot.Live for wealth management. This capability allows users to monitor the performance of their investments comprehensively. It provides real-time updates on portfolio performance metrics such as returns, volatility, and asset allocation. Additionally, Copilot.Live generates detailed reports and analytics, enabling users to assess the effectiveness of their investment strategies and make informed decisions. These tracking and reporting features ensure transparency, accountability, and actionable insights, empowering users to optimize their financial portfolios effectively.

Integration With Market Data And News Feeds

Integration with market data and news feeds is crucial for Copilot.Live in wealth management. This feature enables real-time access to up-to-date financial information, including stock prices, market trends, economic news, and more. By integrating with reputable data sources, Copilot.Live ensures that users have timely and accurate information to make informed investment decisions. This integration enhances the platform's analytical capabilities, supporting users in monitoring market developments and adjusting strategies accordingly. It's a vital tool for staying competitive and responsive in dynamic financial markets, empowering users to seize opportunities and manage risks effectively.

Enhancing Wealth Management With Copilot.Live Chatbot Creation

Creating a chatbot for wealth management through Copilot.Live offers robust capabilities to optimize client interactions and operational efficiencies. This solution enables seamless integration, customization, and deployment of AI-powered chatbots tailored to meet specific industry needs. From personalized client engagement to automated transaction processing and regulatory compliance, Copilot.Live empowers firms to deliver superior service and streamline internal processes. Continuous learning through machine learning ensures chatbots evolve to deliver relevant insights and improve user interactions, positioning wealth management firms for sustained growth and client satisfaction.

Transform Your Wealth Management With Copilot.Live Chatbot Solutions

Discover how Copilot.Live revolutionizes wealth management with advanced AI-powered chatbot solutions. Our platform empowers financial advisors and firms to enhance client engagement, streamline operations, and achieve business growth. By leveraging state-of-the-art technologies like natural language processing (NLP), machine learning (ML), and real-time analytics, Copilot.Live ensures personalized client interactions and proactive decision-making capabilities.

Whether automating routine tasks, providing real-time portfolio insights, or integrating seamlessly with existing CRM systems, our chatbots optimize efficiency and elevate service standards. Clients benefit from 24/7 support, personalized investment advice, and secure transaction execution, all while maintaining stringent data security and compliance measures. Take your wealth management capabilities to the next level with Copilot.Live. Contact us today to explore how our chatbot solutions can transform your financial services, improve client satisfaction, and drive business success.

คำถามที่พบบ่อย

คุณสามารถติดต่อเราได้หากมีข้อสงสัย ข้อเสนอแนะ หรือข้อเสนอแนะใดๆ ผ่าน [email protected] หรืออ่านด้านล่าง

A. Copilot.Live chatbot enhances wealth management by offering AI-powered tools for client engagement and operational efficiency.

A. It automates client interactions, provides real-time insights, and enhances customer service, improving overall efficiency and client satisfaction.

A. Yes, it offers customizable user interfaces and conversational flows to suit your firm’s unique needs and branding.

A. Absolutely, it seamlessly integrates with popular CRM systems, ensuring data continuity and workflow efficiency.

A. It employs robust data security protocols and privacy controls to safeguard client information and comply with industry regulations.

A. Yes, it’s scalable to manage large volumes of client queries and transactions efficiently, ensuring smooth operations even during peak times.

A. It uses AI-driven analytics to offer personalized investment recommendations based on client profiles and market trends.

A. Yes, it provides real-time analysis of portfolios, enabling advisors to make informed decisions promptly.

A. Yes, it provides comprehensive training and ongoing support to maximize the chatbot’s effectiveness and user satisfaction.

A. Contact us to schedule a demo and learn how our chatbot solutions can transform your wealth management practices.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)