Get Your Copilot

AI Chatbot for Insurance

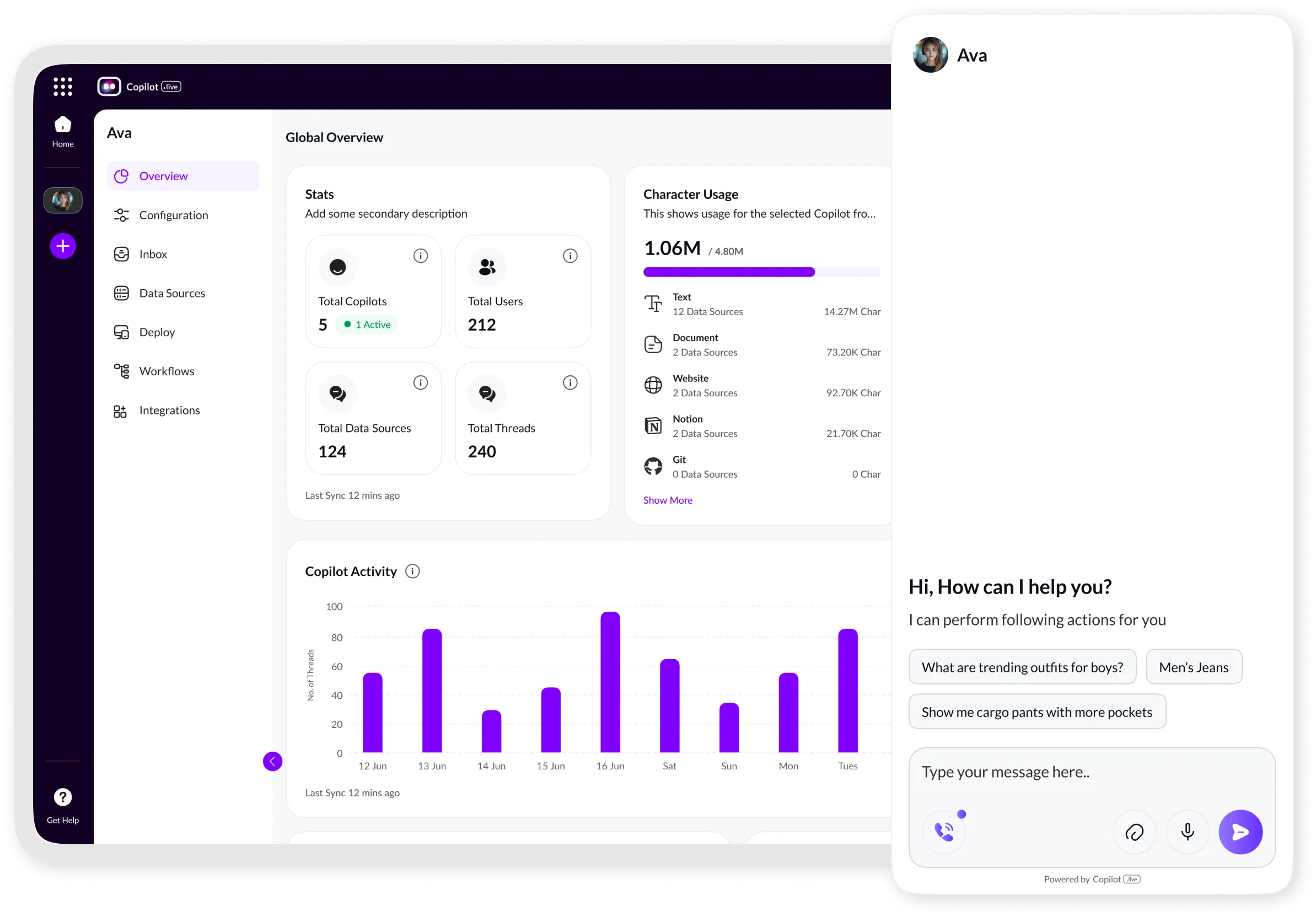

Create an AI chatbot for your insurance agency or company using Copilot.live to assist customer interactions, automate processes, and scale agent productivity.

AI Chatbot for Insurance

Create an AI chatbot for your insurance agency or company using Copilot.live to assist customer interactions, automate processes, and scale agent productivity.

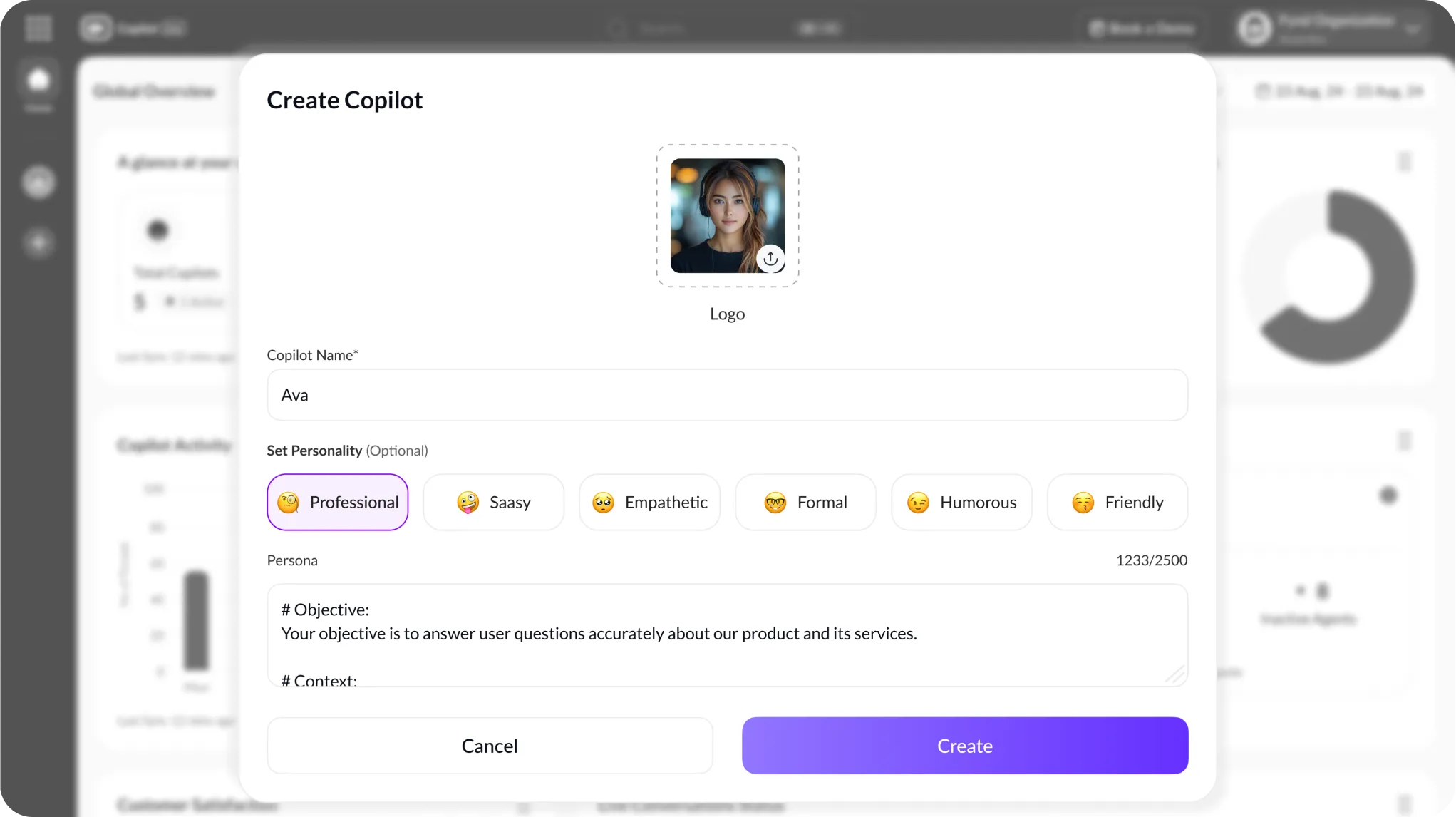

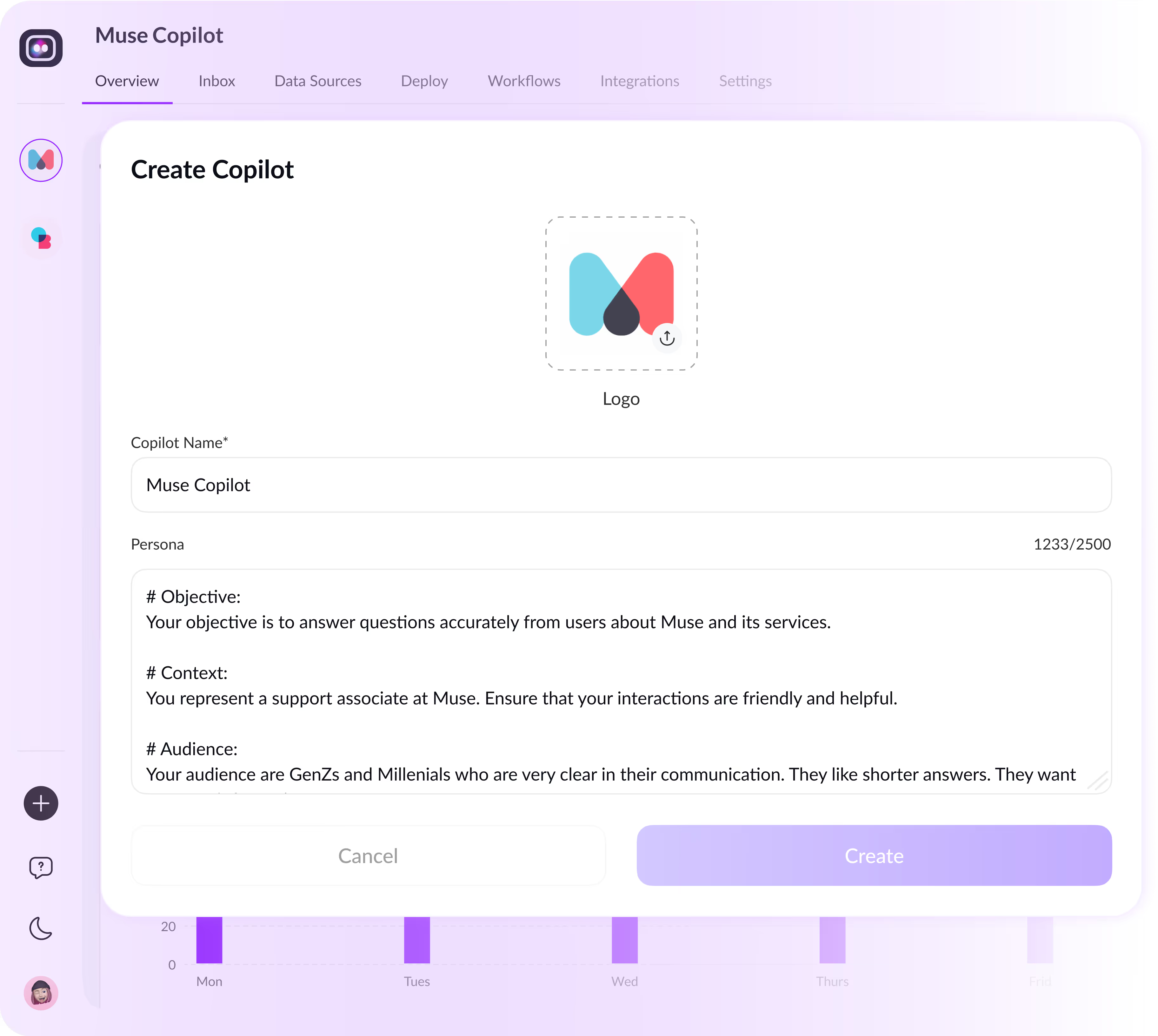

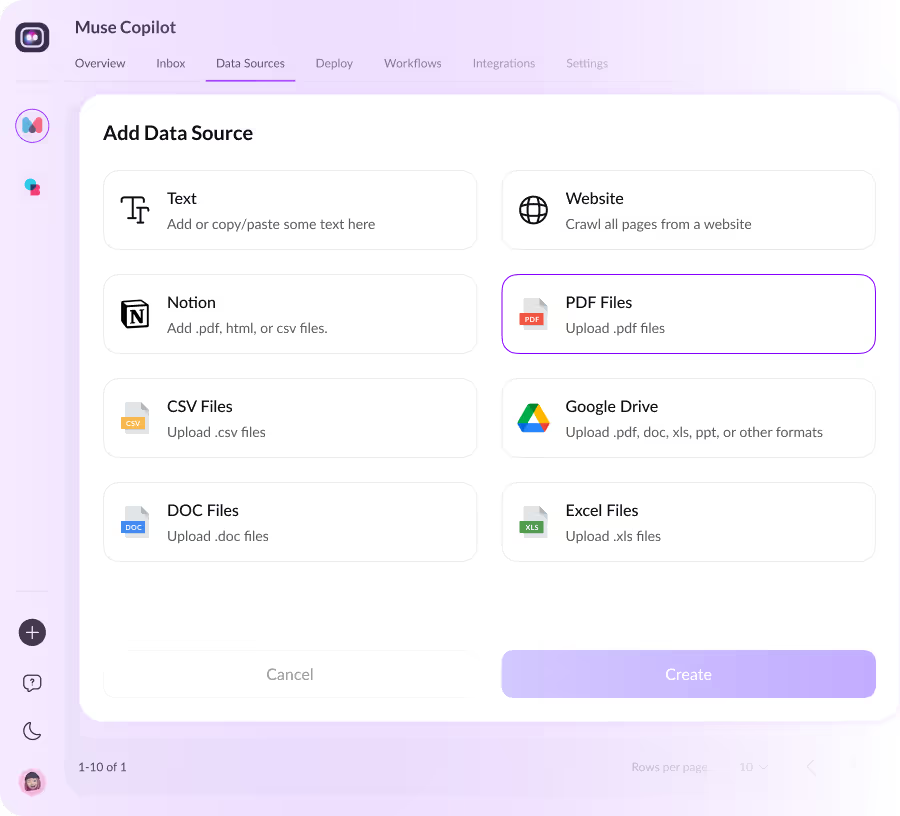

Build an AI assistant in 3 minutes

Create your insurance chatbot with Copilo.live an easy process

Viste site Copilo.live

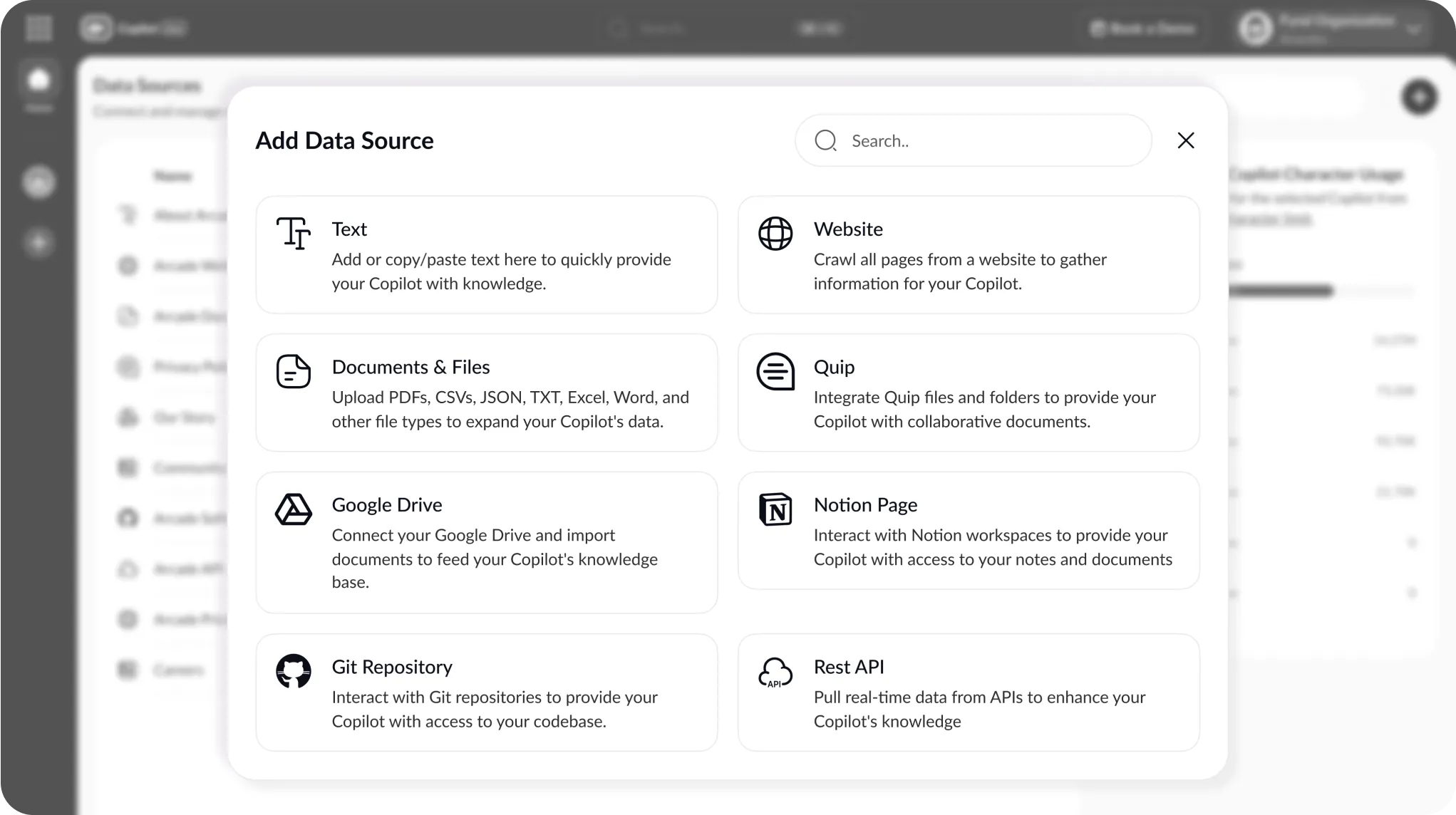

Making your insurance chatbot with Copilot.live is super easy and quick. To get going, just go to Copilo.live.

Create an Account

You will sign up or log in to create your chatbot. You’ll need to enter your info, like FAQs, policy details, etc. The chatbot can help your customers.

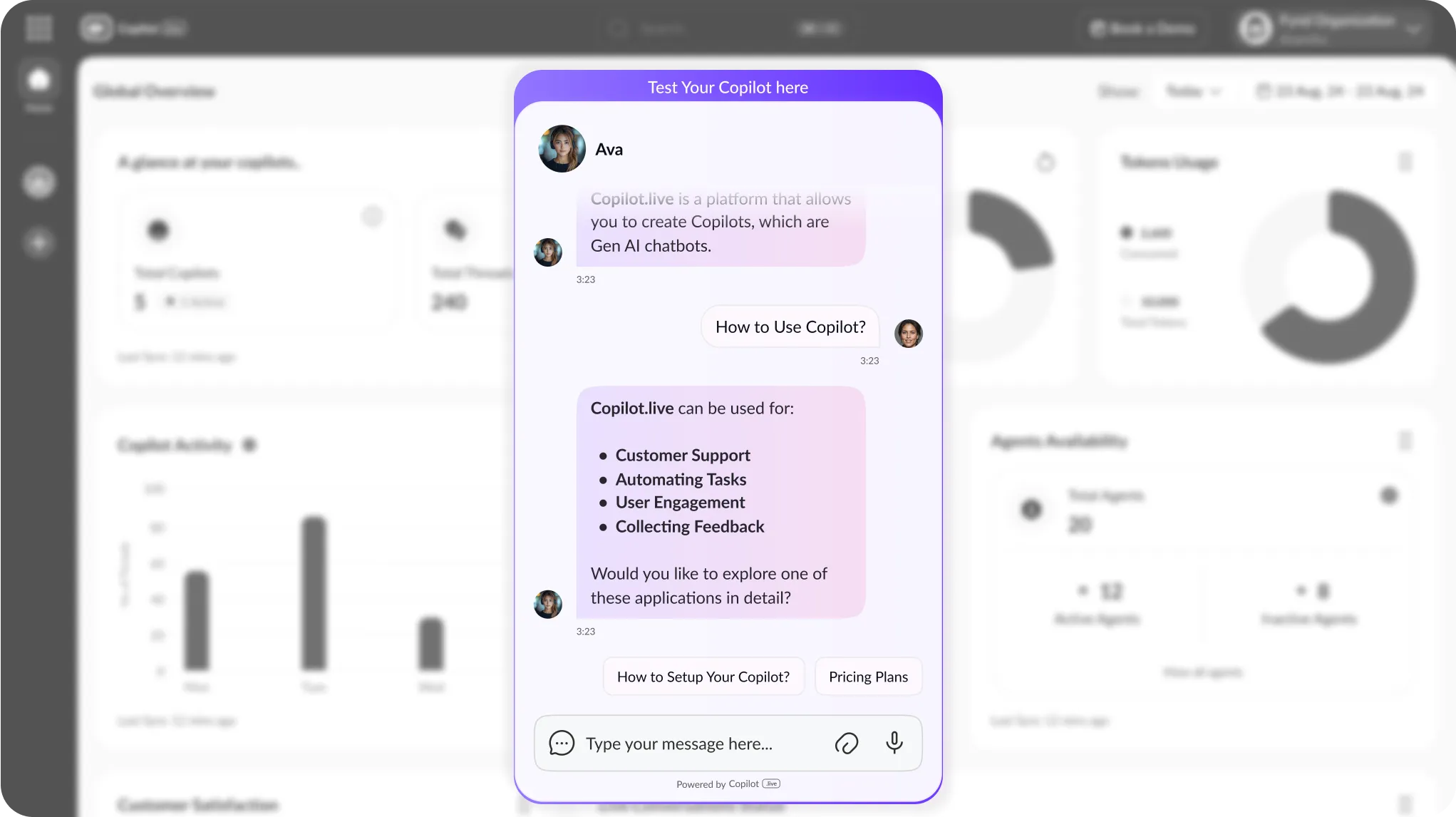

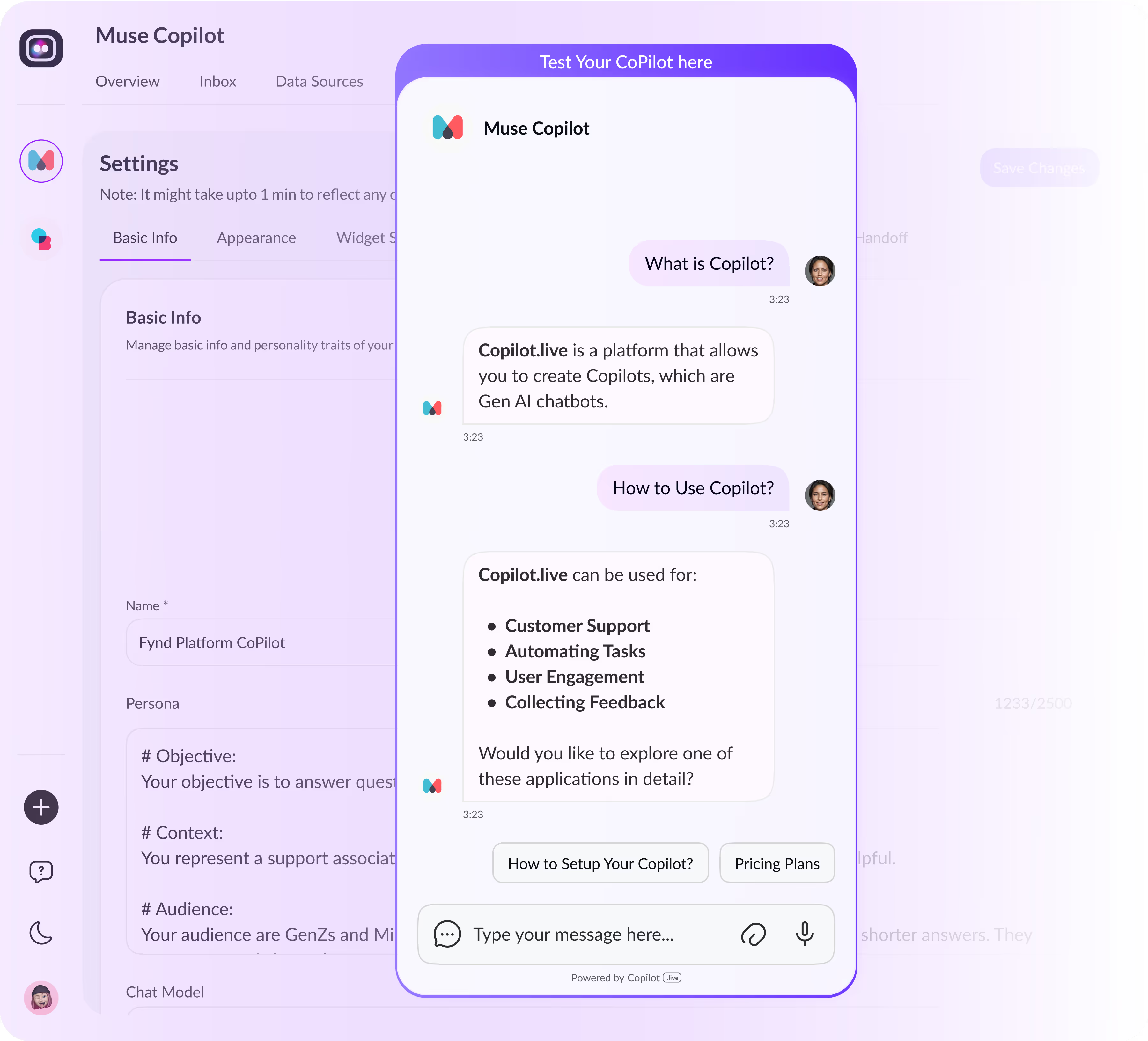

Testing and Optimization

After setting it up, please test it out! You want to ensure it gives the right answers and feels good, and you should change things to make it even better.

Deployment and Monitoring

The last step is to deploy & keep an eye on your chatbot. Once it’s live, monitor how it performs and update whenever necessary.

What is an insurance chatbot?

An insurance AI chatbot acts like your smart helper, programmed using AI and NLP with the help of machine learning to replace your human agent and interact with your customers using AI. It will help your customers with their insurance needs, offering them efficient, personalized, and 24/7 communication solutions. It can answer questions and guide through policy choices. It will also help with claims fast and well.

Using this chatbot makes customer service easier. It solves regular questions, so you save time while getting quick help. Your chatbot is ready to explain if your client needs policy info, updates on a claim, or any other insurance-related information. Insurance becomes a lot simpler and stress-free with it.

Why do you need an insurance chatbot in your insurance business?

Efficient Agent Support

All your customers can get basic information about their policies, inquire about policies, subscriptions, and add-on plans, and reset their passwords.

The AI insurance chatbot will instantly provide pricing and quotes for insurance, claim processing, and coverage checking, and solve all your customers' policy-related issues with the help of advanced AI.

Responsive Digital Interactions

The chatbot will help you provide excellent self-service customer support using AI across all engagement points. Our AI insurance chatbot can be easily integrated with all AI-powered agents, including other advanced AI tools and applications. You can add our AI chatbot to all your existing systems and processes to ensure all your interactions move smoothly.

Voice-Enabled Support

Our chatbot is highly capable of learning from previous customer data. The AI insurance chatbot uses natural language processing (NLP) and machine learning (ML) to accurately understand the chatbot and customer conversation. According to the insurance database, all the information given by the chatbot is very clear and accurate. The chatbot can give faster, correct answers and route all messages.

Unified Omnichannel Experience

The Chabot is designed in such a way that it handles all conversations together, either via email, chat, or phone calls. It helps agents assist, digital, and voice, integrate into a cohesive support ecosystem. The Chabot is advanced and capable of understanding different channel messaging, faster issue resolution, and the flexibility for customers to switch between channels without losing context or having to repeat information.

Who should have an insurance chatbot?

You need an insurance chatbot if you have an insurance company or provide any insurance service or agency. It’s good for giving instant help, answering questions, and making everything flow better. Whether you offer health, auto, life, or home insurance doesn't matter. A chatbot will help your customers 24/7. If you are a broker or an agent, you will use it to simplify policy recommendations, speed up claims, and improve customer satisfaction. No matter how big your business is, an insurance chatbot will make things easy.

Key features & benefits of Copilo.live chatbot for insurance

Get here all the key features and benefits of your company's insurance chatbot.

24/7 Customer Support

You will get the complete advantage of 24/7 customer support from the AI insurance chatbot, which will give you uninterrupted customer support. The AI insurance chatbot will help you get all the information to your customers, which will satisfy them by giving accurate and correct information. The chatbot can provide your customer with information about their policies, get quotes, check coverage, or even reset passwords. This will ensure no human agent is involved in the self-help process.

Claims Processing

The most important process of claims processing is time-consuming. The traditional method involves much manual work, paperwork, and human agent involvement. The AI insurance chatbot will help your customers file claims, answer insurance-related queries, and provide the status of claim settlements. If the chatbot handles the claims process, it will be error-free, and there is no chance of adding wrong information while processing claims. You will get all the information about the claims process method using just a chatbot without the involvement of a human agent.

Cost-Effective Solution

The AI insurance chatbot will help automate customers' routine inquiries, claims, and tasks (such as claims processing, policy-related questions, and premium-related queries). The AI chatbot will help reduce the dependencies on human agents (employees), saving money on the agents' salaries and time. This automated AI insurance chatbot process will fast-track customer replies and responses, lowering operational costs and minimizing human error.

Multilingual support

The insurance chatbot is AI-powered and can reply to your customers in all the languages available on the planet in the mainstream. This advanced feature of the modern AI chatbot will help your customers interact and communicate with the AI agent in their preferred language. This feature will help your insurance company reach a diverse customer range, breaking down language barriers and expanding its market reach. Our AI insurance chatbot can help you connect with customers in more than 150+ languages with text or use our voice call feature to interact with your potential customers.

Insurance Chatbot Use Case in Various Industries

Health Insurance

The insurance chatbot helps your customers find the right health insurance plan. It answers questions about the coverage of their claims. It can suggest great options to your customers. It also helps with claim submissions in less time. This makes healthcare easier to understand.

Auto Insurance

The insurance chatbot guides users through choosing a policy for their customers' vehicles. It helps with critical accident reporting and sending reminders to renew their insurance, helping to boost your business. Users can also check their claim status without making phone calls to you.

Life Insurance

Your chatbot, with the help of AI, assists your customers in understanding life insurance policies in many ways. It helps them find the best plan for what they need from you. An insurance chatbot provides step-by-step guidance for applications and even reminds users of premium payments.

Home Insurance

Now, your customers will simplify their home insurance with an insurance chatbot! Quick answers about policies, coverage, and claims are ready for homeowners. Your chatbot assists in protecting their property with funds and helps file claims if there's any harm.

Travel Insurance

Your chatbot is going to support travelers! It will quickly offer insurance options for your customers' trips. Your customer will ask about losing their bags and luggage? Or medical emergencies? Don’t worry; it’s also here to help with your customers' trip cancellations. This way, your travelers can enjoy peace of mind.

Business Insurance

Your chatbot is helpful for business owners. It will show them how to get the right coverage for their company. It guides users through liability insurance, workers' compensation, and property protection. This makes everything smoother.

Marine Insurance

Your chatbot assists shipping companies in protecting their cargo and vessels from drowning. It provides all the related insurance details about policies, helps with claim filings for damaged goods, & makes logistics management easier. They will also calculate the overall damage price, etc.

Pet Insurance

Your customer will help pet owners find the best coverage for their lovely friends. Your chatbot gives lots of details about policies. It can suggest good plans & even help with filing claims for those vet bills. They will also provide other information regarding the order insurance plan.

Best Practices for a Successful Insurance Chatbot

First of all, you need to make your insurance chatbot very simple. The chatbot should be easy for customers to use and give correct answers. It depends on the training you give your chatbot. It will help users easily navigate insurance stuff without any confusion. This chatbot will be there for your customers 24/7. Customers can get help anytime they need it. It will answer common questions, help with claims, and give policy info right away, saving time for customers and your team.

Personalization is really important. Your chatbot will say hello to users by their names. It will also suggest the best insurance plans that fit their needs. It remembers what was talked about before, making each chat more handy.

Frequently Asked Questions

You can reach out to us in case of any queries, feedback, or suggestions via [email protected] or read below.

A. An insurance chatbot is a computer program that answers customers' questions about insurance quickly.

A. These chatbots use AI (artificial intelligence) and natural language processing (NLP) to help them understand customer questions and respond immediately.

A. They are available 24/7. Customers get instant answers to their questions from your customers. It reduces the workload for human agents & scales up your business.

A. Yes, Insurance chatbots can give you quotes for different policies.

A. Yes, as long as they are from reputable sources.

A. Yes, Insurance chatbots learn from a lot of information and keep getting better by learning from every conversation they have.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)