Get Your Copilot

Create A Chatbot For Finance

Experience the future of Finance with Copilot.Live cutting-edge chatbot. Revolutionize your financial management with AI-powered assistance. Take control of your finances effortlessly.

Create A Chatbot For Finance

Experience the future of Finance with Copilot.Live cutting-edge chatbot. Revolutionize your financial management with AI-powered assistance. Take control of your finances effortlessly.

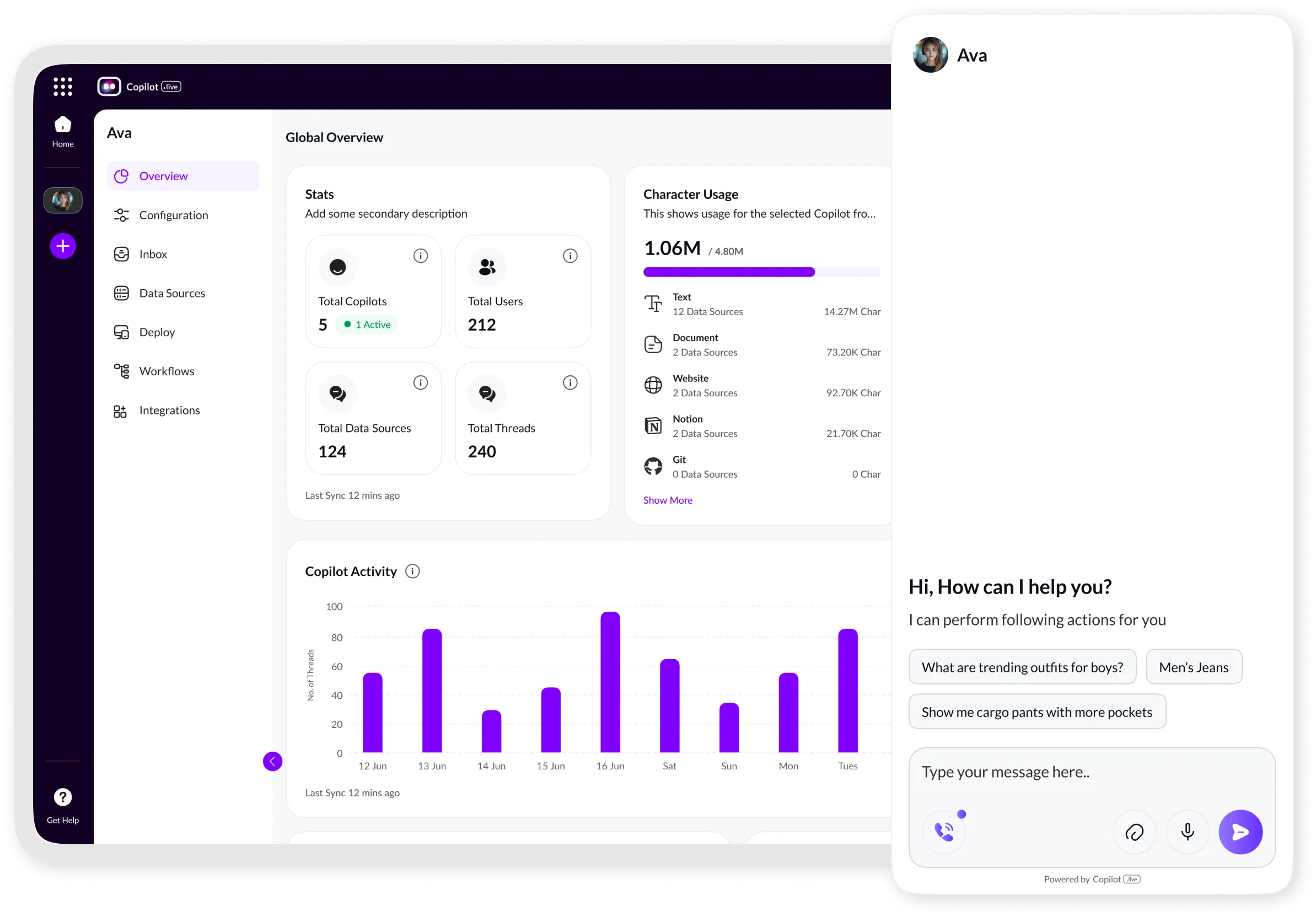

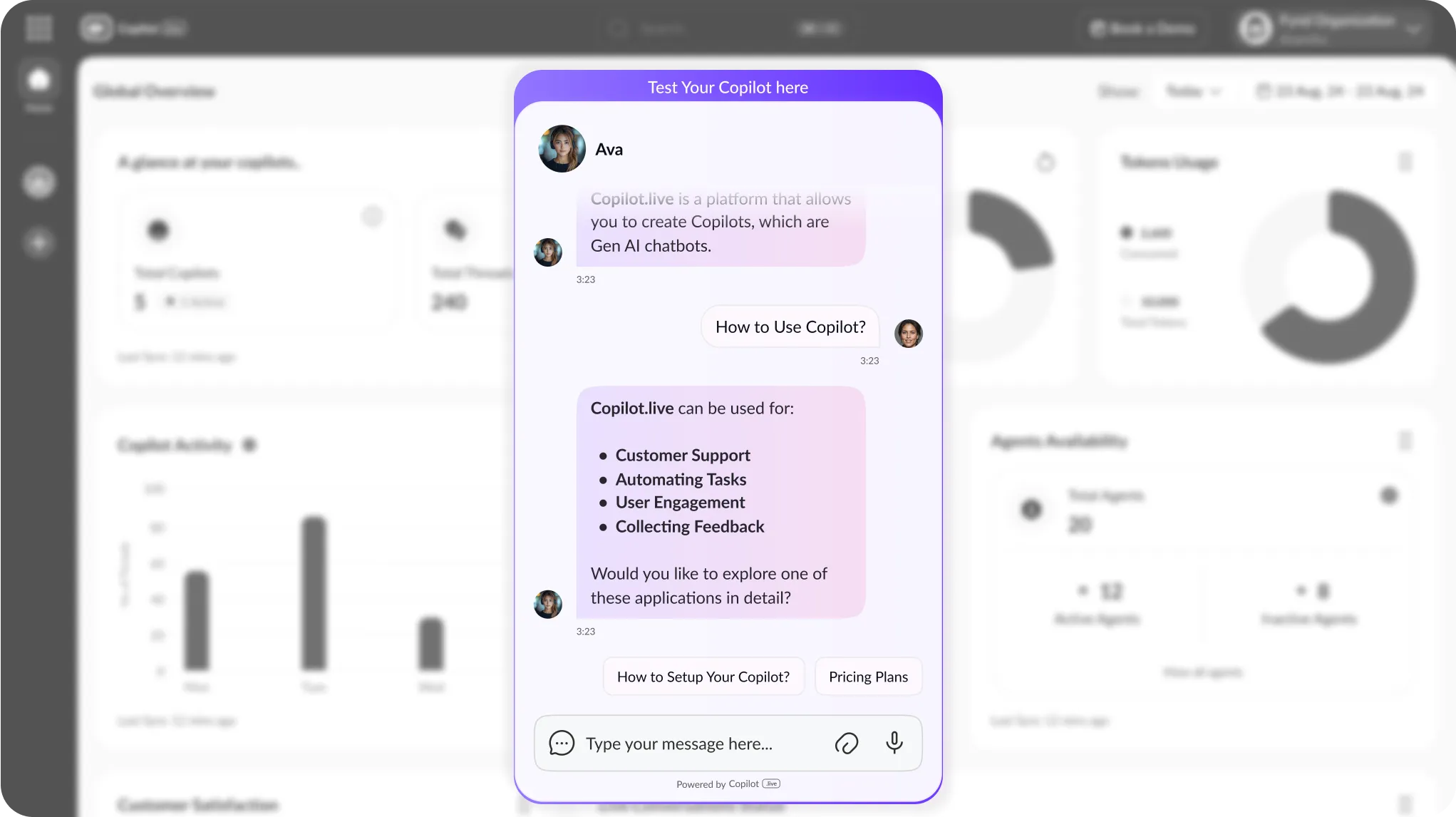

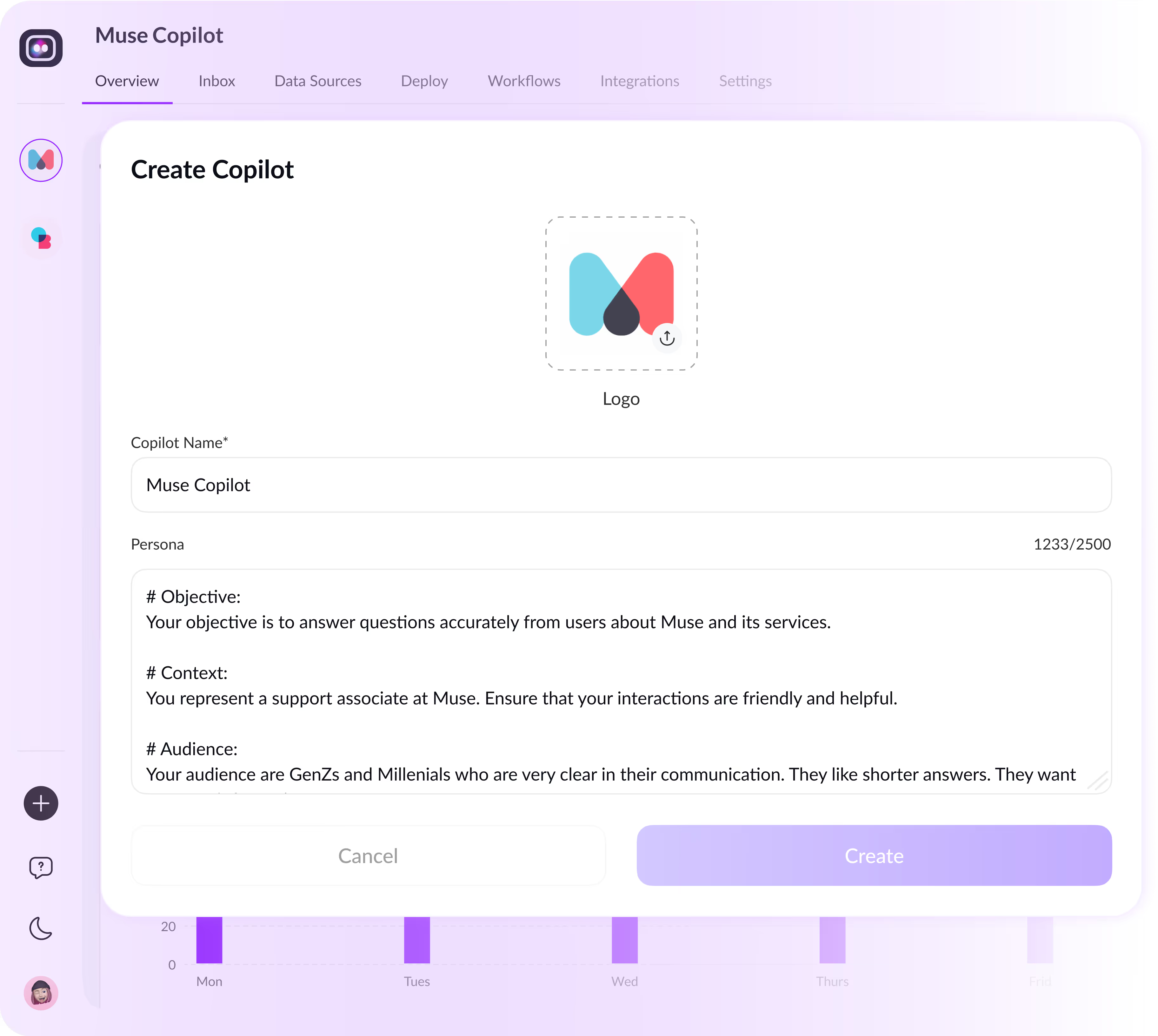

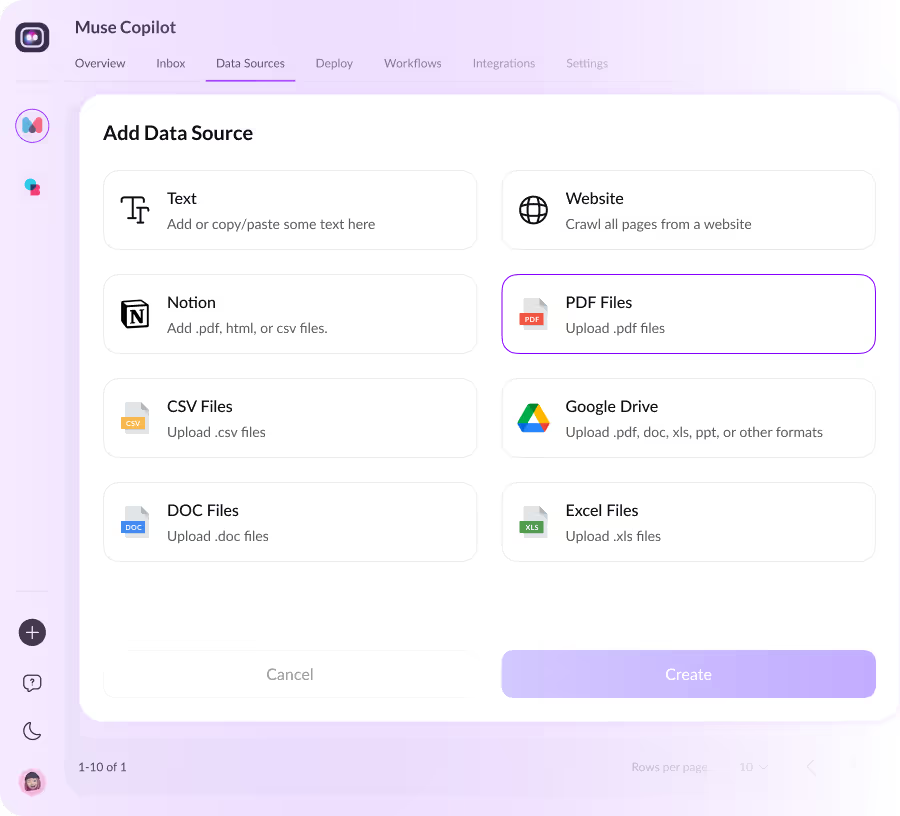

Build an AI assistant in 3 minutes

Effortlessly Create Your Finance Chatbot With Copilot.Live Streamlined Process.

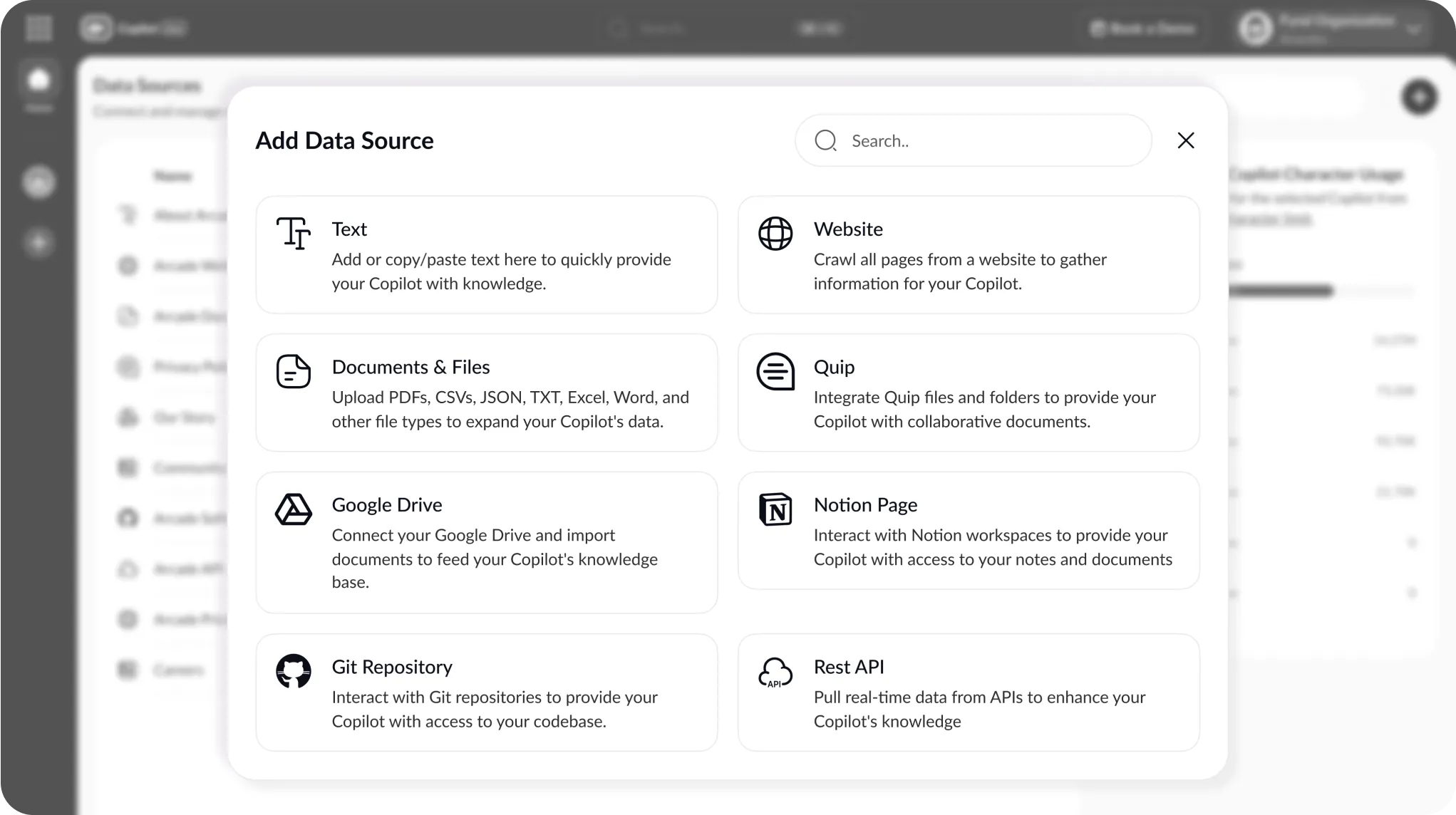

Input Your Financial Data

Effortlessly upload your financial data and customer information into the chatbot platform. This step ensures your chatbot is equipped with the information to understand user inquiries accurately and provide relevant responses tailored to the finance domain.

Train AI For Finance Expertise

Utilize intuitive training tools to enhance your chatbot's understanding of financial queries. Through ongoing training, refine its capabilities to provide precise insights and valuable information specific to the intricacies of the finance industry, ensuring it delivers expertise-driven responses to user inquiries.

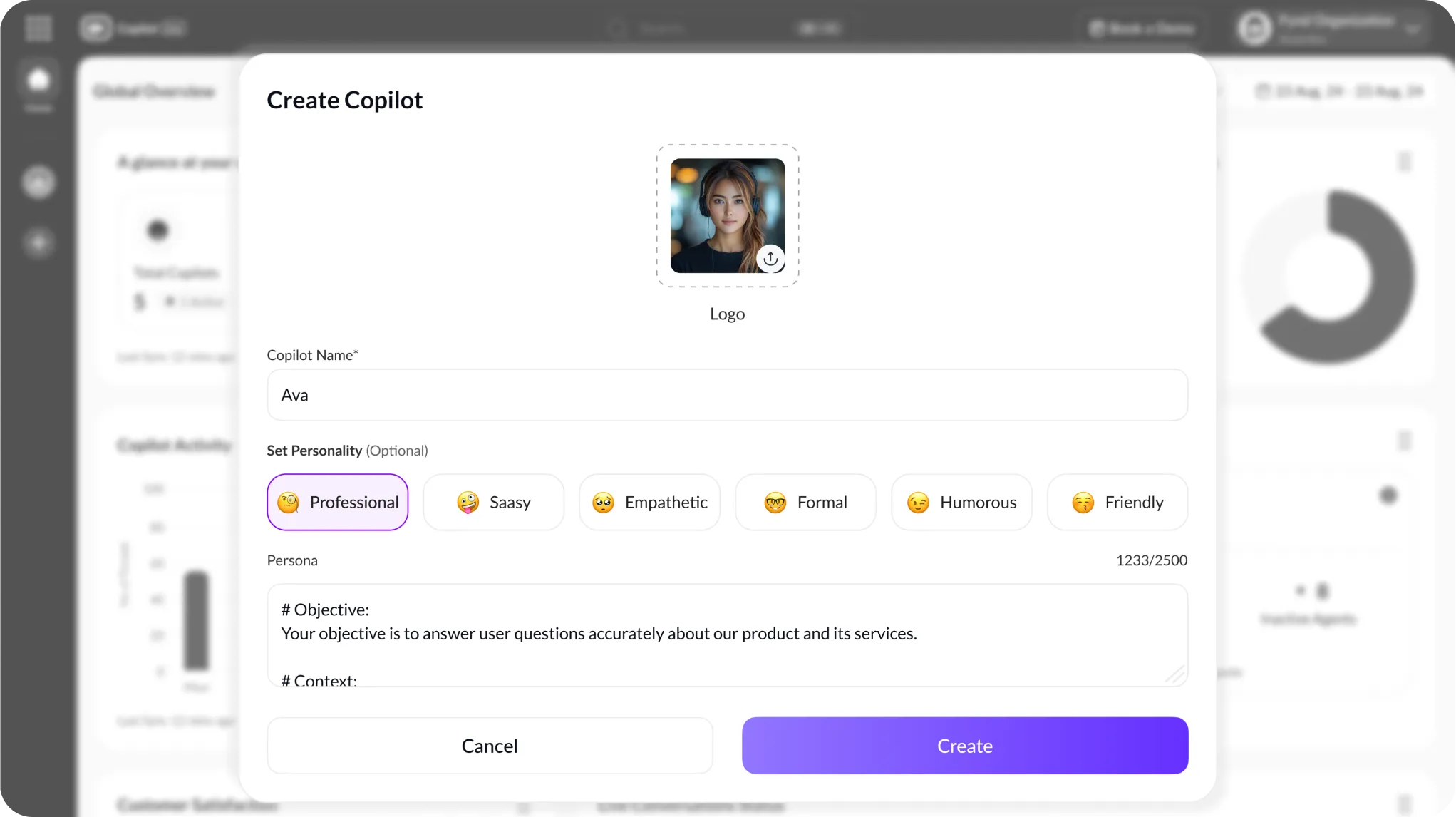

Customize For Your Brand

Personalize your chatbot's appearance, tone, and responses to align with your finance brand's identity. By infusing your brand's voice and values, you create a more engaging and authentic user experience, fostering stronger connections and trust among users interacting with your chatbot.

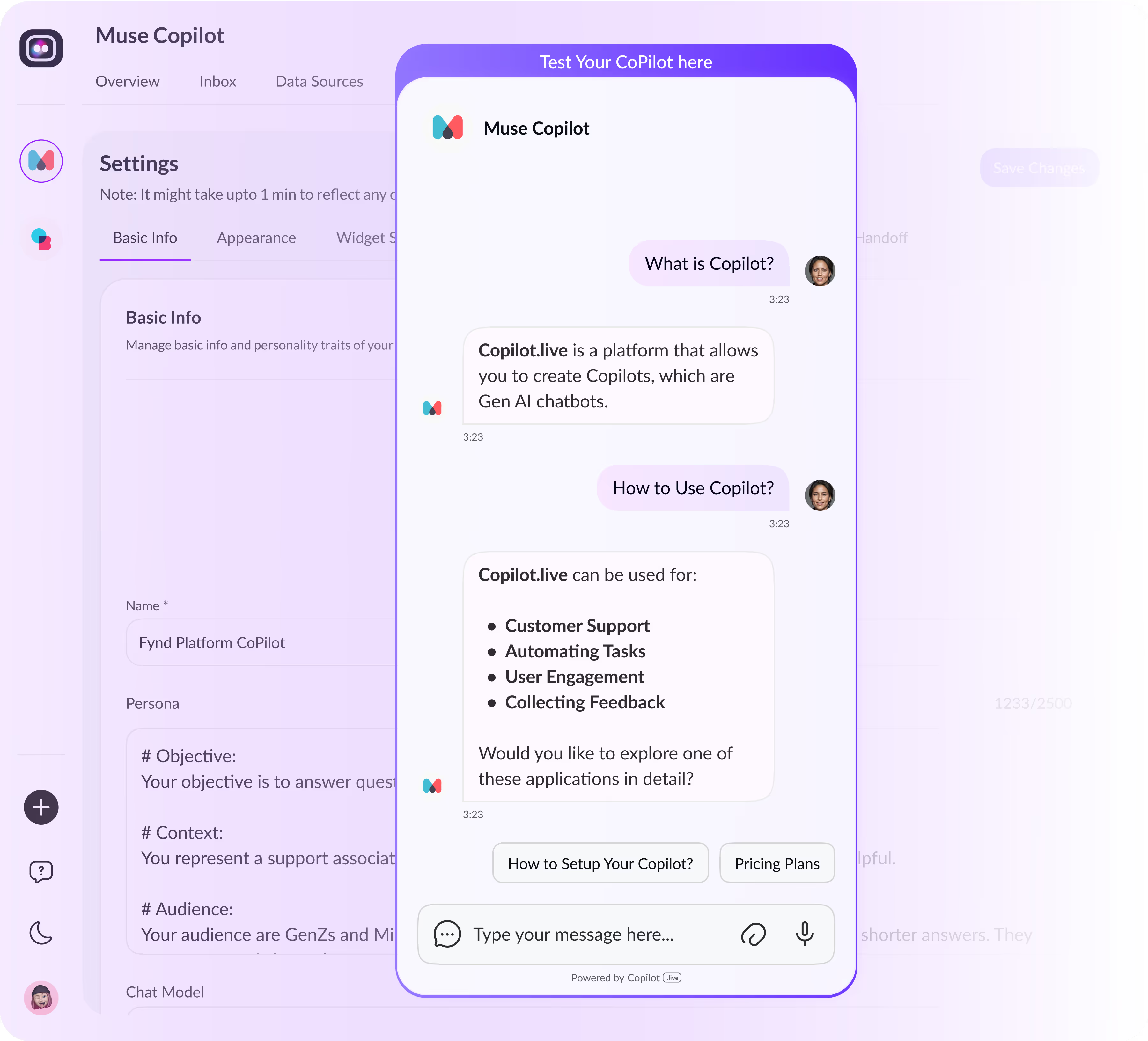

Deploy With Confidence

Leverage the user-friendly interface and comprehensive support the chatbot platform provides to deploy your customized chatbot across your finance service platform confidently. With seamless integration and reliable assistance, you can trust your chatbot to perform effectively, delivering exceptional user experiences and driving positive outcomes for your brand.

Empower Your Financial Journey With Our Finance Chatbot

In today's fast-paced digital landscape, managing Finances efficiently is paramount. Introducing our Finance Chatbot, designed to revolutionize how you interact with financial services. Seamlessly integrating into your banking or financial institution's platform, our chatbot streamlines processes, providing instant access to vital information and personalized assistance. With intuitive AI technology, it understands complex financial queries, offering tailored insights and solutions. Say goodbye to lengthy wait times and cumbersome paperwork our chatbot ensures swift responses and hassle-free transactions.

Whether it's tracking expenses, receiving financial advice, or detecting fraud, our chatbot is your trusted companion every step of the way. Customizable to reflect your brand's identity, it enhances user engagement and fosters stronger connections with clients. Experience the future of Finance management with our innovative chatbot solution, empowering you to navigate your financial journey confidently and efficiently.

Why Opt For Copilot.Live For Your Finance Service Chatbot Needs?

Automated Budget Management

Effortlessly track and manage your expenses with our chatbot's automated budgeting feature. By analyzing your spending patterns and income streams, it provides real-time insights into your financial health. Set budget goals, receive alerts for overspending, and make informed decisions to achieve your financial objectives faster. With this feature, you can take control of your finances and optimize your budgeting strategies for better financial stability and success.

Investment Portfolio Analysis

Our chatbot's advanced analysis capabilities will give you deeper insights into your investment portfolio. It aggregates and analyzes investment data, offering personalized recommendations and performance insights. Whether you're a novice investor or a seasoned pro, our chatbot provides the information needed to make informed investment decisions. Stay updated on market trends, assess risk factors, and optimize your investment portfolio for maximum returns and long-term growth.

Tax Planning Assistance

Simplify tax planning and preparation with our chatbot's dedicated tax assistance feature. It guides you through the tax filing, helping you identify potential deductions, credits, and tax-saving opportunities. By staying organized and informed about tax laws and regulations, you can minimize your tax liability and maximize your refunds. Our chatbot ensures compliance with tax obligations while optimizing your tax strategy for financial efficiency and peace of mind.

Goal-Based Financial Planning

Achieve your financial goals faster with our chatbot's goal-based planning feature. Set specific financial objectives, such as saving for a home, retirement, or education, and our chatbot creates personalized plans to help you reach them. It tracks your progress, suggests actionable steps, and adjusts strategies to keep you on track towards financial success. With goal-based planning, you can turn your dreams into achievable milestones and secure a brighter financial future.

Empower Your Finances With Our Finance Chatbot

Dive into the future of Finance management with our cutting-edge chatbot explicitly tailored to your financial needs. Say goodbye to cumbersome spreadsheets and endless calculations our chatbot simplifies the complexities of financial management, putting you in control of your money like never before. With intuitive AI technology, our chatbot offers personalized insights, budgeting assistance, investment guidance, and tax planning support in one convenient platform.

Whether tracking expenses, optimizing your investment portfolio, planning for taxes, or working towards your financial goals, our chatbot streamlines the process, saving you time and effort. Experience the convenience of 24/7 access to financial assistance, tailored recommendations, and actionable insights, empowering you to make informed decisions and achieve financial success. Take the first step towards financial freedom and unlock the full potential of your money with our Finance chatbot.

Key Features & Benefits Of Copilot.Live Chatbot For Finance

Discover the essential features and benefits of Copilot.Live chatbot is tailored for Finance. Streamline your financial management and unlock new possibilities for achieving your financial goals.

Advanced Budgeting Assistance

Copilot.Live chatbot offers advanced budgeting assistance, allowing users to set, track, and analyze their budgets effortlessly. With intelligent algorithms, it provides personalized recommendations and insights to help users optimize their spending and savings habits, ultimately improving their financial health.

Goal-Based Savings Plans

Users can create and manage goal-based savings plans with Copilot.Live chatbot. By setting specific financial goals, such as saving for a vacation or buying a home, the chatbot helps users develop actionable plans, track progress, and stay motivated, empowering them to achieve their dreams quickly.

Investment Portfolio Management

Copilot.Live chatbot offers comprehensive investment portfolio management capabilities. Users can access real-time updates on their investment portfolios, receive personalized investment recommendations, and make informed decisions to maximize returns and minimize risks, ensuring their investments align with their long-term financial objectives.

Financial Education Resources

The chatbot provides access to a wealth of financial education resources, including articles, tutorials, and interactive tools. Users can enhance their financial literacy, learn about various financial topics such as budgeting, investing, and retirement planning, and make informed decisions to improve their financial well-being over time.

Launch Your AI-Powered Chatbot For Finance In No Time

Automated Bill Payment Reminders

Automated bill payment reminders streamline financial management by ensuring bills are always noticed. This feature notifies users of upcoming payments, helping them stay organized and avoid late fees or penalties. By setting personalized reminders based on due dates and payment frequencies, users can maintain control over their finances with minimal effort. With this functionality, users can rest assured that their bills will be paid on time, contributing to improved financial health and peace of mind.

Expense Categorization

Expense categorization simplifies financial tracking by automatically sorting expenses into predefined categories. Users can easily monitor their spending habits and identify areas where they can save or cut back. This feature eliminates manual entry and ensures accuracy in financial records. By organizing expenses such as groceries, utilities, and entertainment, users gain insights into their financial behaviour and can make informed decisions to achieve their financial goals. Ultimately, expense categorization enhances financial awareness and enables users to manage their budgets for better financial stability effectively.

Personalized Investment Recommendations

Personalized investment recommendations leverage user data and machine learning algorithms to suggest tailored investment strategies. By analyzing factors such as risk tolerance, financial goals, and investment preferences, the chatbot provides personalized guidance on asset allocation, portfolio diversification, and specific investment opportunities. These recommendations empower users to make informed decisions aligned with their unique financial circumstances, optimizing their investment returns and minimizing risks. Additionally, the chatbot may offer insights into market trends, economic indicators, and investment best practices, enhancing the user's financial literacy and confidence in their investment decisions.

Retirement Planning Tools

Retirement planning tools within a Finance chatbot enable users to estimate their retirement needs, set savings goals, and develop actionable retirement plans. These tools typically incorporate current age, desired retirement age, life expectancy, expected inflation rates, and retirement income sources (e.g., pensions, Social Security, savings accounts). By analyzing this information, the chatbot generates personalized retirement projections, recommends savings targets, and suggests investment strategies to achieve retirement goals. Users can simulate different scenarios, adjust variables, and visualize the impact of their financial decisions on their retirement readiness, empowering them to make informed choices and secure their financial future.

Credit Score Monitoring

Credit score monitoring is a feature in Finance chatbots that allows users to track changes in their credit scores over time. By connecting to credit reporting agencies, the chatbot retrieves and displays users' credit scores and provides notifications for significant changes, such as new account openings, missed payments, or credit inquiries. Additionally, it offers insights into factors influencing credit scores, such as credit utilization, payment history, and length of credit history. Users can set up alerts for potential fraud or identity theft, enabling them to take timely actions to protect their credit profiles. This proactive monitoring helps users maintain healthy credit habits and achieve their financial goals by identifying areas for improvement and addressing issues promptly.

Tax Filing Assistance

Tax filing assistance is a feature of Finance chatbots to simplify preparing and filing taxes. These chatbots guide users through the various steps in completing their tax returns, including gathering necessary documents, filling out forms, and identifying eligible deductions and credits. They use natural language processing to understand users' tax-related queries and provide accurate responses and explanations. Additionally, they may offer reminders and deadlines for tax-related tasks, helping users stay organized and avoid penalties for late filings. Some chatbots can even file taxes electronically on behalf of users, streamlining the entire process and reducing the likelihood of errors. Overall, tax filing assistance chatbots make the often complex and daunting task of filing taxes more manageable and less stressful for individuals.

Debt Management Strategies

Debt management strategies offered by Finance chatbots assist users in effectively managing their debts to achieve financial stability. These strategies include creating personalized repayment plans based on users' financial situations, prioritizing high-interest debts, and negotiating with creditors for lower interest rates or extended payment terms. Chatbots may also provide budgeting tools to help users allocate funds towards debt repayment, track progress, and identify areas where they can cut expenses or increase income to accelerate debt payoff. Additionally, they may offer resources and educational materials on debt management techniques, such as debt consolidation, debt settlement, and debt snowball or avalanche methods. By empowering users with tailored strategies and actionable advice, these chatbots enable them to take control of their debt and work towards achieving long-term financial freedom.

Financial Goal Tracking

Financial goal-tracking features in Finance chatbots enable users to set, monitor, and achieve their financial objectives effectively. Users can define goals such as saving for emergencies, purchasing a home, or retirement planning. The chatbot assists in creating realistic goals by analyzing the user's financial status and providing personalized recommendations. It tracks progress over time, sending reminders and alerts to keep users on track. Additionally, it offers insights into spending habits and suggests adjustments to align with financial goals. Through visual representations like charts and graphs, users can visualize their progress, motivating them to stay committed to their financial journey. With goal-tracking capabilities, users can establish a clear roadmap towards financial success and make informed decisions to reach their aspirations.

Real-Time Market Updates

The real-time market updates feature in Finance chatbots provides users with timely information on stock prices, market trends, and financial news. Users can stay informed about the latest developments in the financial markets, allowing them to make well-informed investment decisions. The chatbot aggregates data from various sources, including stock exchanges and financial news outlets, to deliver up-to-date information directly to users. This feature lets users track their investment portfolios and seize opportunities to buy or sell assets based on current market conditions. By receiving real-time updates, users can react promptly to market changes, mitigate risks, and capitalize on potential investment opportunities, enhancing their overall financial management experience.

Interactive Budgeting Tools

Interactive budgeting tools empower users to manage their finances effectively by providing interactive features such as customizable budget templates, expense tracking, and goal setting. Users can input their income, expenses, and financial goals into the chatbot, generating personalized budget plans tailored to their needs. These tools allow users to track their spending habits, identify areas for saving, and adjust their budgets accordingly. Additionally, interactive budgeting tools often include visualizations like charts and graphs to help users visualize their financial data and track their progress over time. By offering interactive features and personalized insights, these tools enable users to take control of their finances, make informed decisions, and work towards achieving their financial goals more efficiently.

Investment Performance Analytics

Investment performance analytics provide users with detailed insights into the performance of their investment portfolios. These analytics tools analyze various metrics such as returns, volatility, risk-adjusted returns, and portfolio diversification to help users assess the performance and effectiveness of their investment strategies. Users can track the performance of individual investments or their entire portfolio over time, enabling them to identify trends, assess performance against benchmarks, and make informed investment decisions. Additionally, investment performance analytics may offer visualizations such as charts and graphs to help users visualize their investment performance and understand complex financial data more efficiently. By providing comprehensive performance analysis, these tools empower users to optimize their investment strategies, mitigate risk, and maximize returns.

Secure Document Storage

Secure document storage ensures that users can safely store sensitive financial documents such as tax returns, investment statements, insurance policies, and legal documents. With encrypted storage and robust security measures, users can trust that their confidential information remains protected from unauthorized access or data breaches. Advanced security features may include encryption, multi-factor authentication, regular backups, and compliance with industry standards such as GDPR or HIPAA. Secure document storage also enables users to organize and access their financial documents conveniently, whether they're accessing them from a computer, smartphone, or tablet. By providing a secure and centralized repository for critical financial documents, this feature offers peace of mind and facilitates better financial organization and management.

Customizable Financial Reports

Customizable financial reports empower users to tailor their financial insights to their needs and preferences. With this feature, users can select relevant metrics, time frames, and data visualization options to create personalized reports that provide valuable insights into their financial health and performance. Whether users want to track spending habits, analyze investment portfolios, or monitor budget adherence, customizable financial reports offer flexibility and control. Users can choose from various report templates, customize layouts, and add annotations or commentary to further enhance their understanding of their financial data. This feature promotes informed decision-making and supports proactive financial management by enabling users to generate reports that align with their unique financial goals and priorities.

Educational Webinars And Workshops

Educational webinars and workshops provide valuable resources for users to enhance their financial literacy and make informed financial decisions. These sessions cover various topics, including budgeting, investing, retirement planning, debt management, etc. Led by financial experts and industry professionals, these interactive sessions offer practical tips, strategies, and insights to help users improve their financial well-being. By attending these webinars and workshops, users can deepen their understanding of critical financial concepts, stay updated on industry trends, and gain actionable knowledge to achieve their financial goals. Additionally, these educational opportunities foster a sense of community among users, allowing them to connect with like-minded individuals, share experiences, and learn from each other's successes and challenges. Overall, educational webinars and workshops are crucial in empowering users to take control of their finances and build a secure financial future.

Integration With Financial Institutions

Integration with financial institutions allows users to securely link their accounts and access real-time financial data directly within the chatbot interface. By connecting to banks, credit card providers, investment accounts, and other financial institutions, users can conveniently view their account balances, transaction history, investment portfolios, and more without leaving the chatbot platform. This seamless integration streamlines the financial management process, providing users a comprehensive overview of their financial status in one centralized location. Moreover, integration with financial institutions enables the chatbot to offer personalized recommendations, insights, and advice based on the user's specific financial circumstances and transactions. With secure authentication protocols and encryption measures, users can trust that their sensitive financial information remains protected throughout the integration process, ensuring a safe and reliable user experience. Overall, integration with financial institutions enhances the functionality and utility of the chatbot, empowering users to make informed financial decisions with ease.

End Your Financial Worries With Our Finance Chatbot

Embark on a journey towards financial empowerment with our cutting-edge Finance Chatbot. Designed to simplify and optimize your financial management experience, our chatbot offers a comprehensive suite of tools and resources tailored to your needs. Whether you're looking to track expenses, set financial goals, or receive personalized investment advice, our chatbot guides you through every step.

Say goodbye to financial stress and hello to financial freedom as you leverage the power of AI-driven insights and automation to take control of your finances like never before. With intuitive features and seamless integration with your existing financial accounts, our chatbot empowers you to make informed decisions, achieve your financial objectives, and secure a brighter financial future. Experience the convenience, efficiency, and peace of mind with a Finance assistant at your fingertips.

What Does A Chatbot For Finance Need To Know?

A chatbot for Finance needs to be equipped with a comprehensive understanding of various financial aspects to assist users effectively. Firstly, it should know basic financial concepts such as budgeting, saving, investing, and debt management. Understanding these fundamentals allows the chatbot to provide relevant advice and guidance tailored to the user's financial situation and goals. Additionally, the chatbot should know current financial market trends, interest rates, and investment opportunities to offer informed recommendations on where users can grow their wealth. It should also have access to up-to-date information on banking products, insurance policies, and retirement planning options to help users make sound financial decisions.

Furthermore, the chatbot should be capable of securely accessing and analyzing users' financial data, including transaction histories, account balances, and credit scores, while ensuring data privacy and security. This enables the chatbot to provide personalized insights and recommendations based on the user's financial behavior and goals. Overall, a chatbot for Finance needs a broad knowledge base encompassing financial concepts, market trends, banking products, and user-specific financial data to deliver valuable assistance and support to users in managing their finances effectively.

Frequently Asked Questions

You can reach out to us in case of any queries, feedback, or suggestions via [email protected] or read below.

A. A Finance chatbot is an AI-powered virtual assistant designed to help individuals manage their finances, offering advice, guidance, and tools for budgeting, saving, investing, and more.

A. A Finance chatbot can help you by providing personalized financial advice, assisting with budgeting and saving goals, offering investment recommendations, monitoring your spending habits, and answering financial questions in real time.

A. Yes, reputable Finance chatbots prioritize data security and employ robust encryption methods to safeguard users' financial information. Additionally, they adhere to strict privacy policies to ensure confidentiality.

A. Yes, many Finance chatbots offer tools and resources for retirement planning, including calculating retirement savings goals, optimizing investment portfolios, and providing guidance on retirement income strategies.

A. Finance chatbots use secure connections and encryption protocols to protect sensitive financial data. They also implement authentication measures and adhere to regulatory standards to ensure data confidentiality and integrity.

A. Yes, most Finance chatbots offer customization options, allowing users to tailor their functionality to their specific financial needs and preferences.

A. Many Finance chatbots are available round-the-clock, providing users with access to financial assistance and guidance whenever they need it, day or night.

A. Finance chatbots typically integrate with various financial institutions and platforms, allowing users to securely connect their bank accounts, credit cards, and investment accounts to access real-time financial data and insights.

A. Yes, Finance chatbots can provide tips and strategies for improving credit scores, such as paying bills on time, reducing debt, and monitoring credit utilization.

A. Yes, Finance chatbots are designed to be user-friendly and accessible, making them suitable for individuals at all levels of financial literacy, from beginners to experienced investors. They offer guidance and educational resources to help users understand and manage their finances more effectively.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)