Get Your Copilot

Create an AI Chatbot For Banking

Increase your banking experience with AI Chatbots. Provide 24/7 customer support with an AI chatbot. Boost your banking performance and security using Copilot.live Banking Chatbots.

Create an AI Chatbot For Banking

Increase your banking experience with AI Chatbots. Provide 24/7 customer support with an AI chatbot. Boost your banking performance and security using Copilot.live Banking Chatbots.

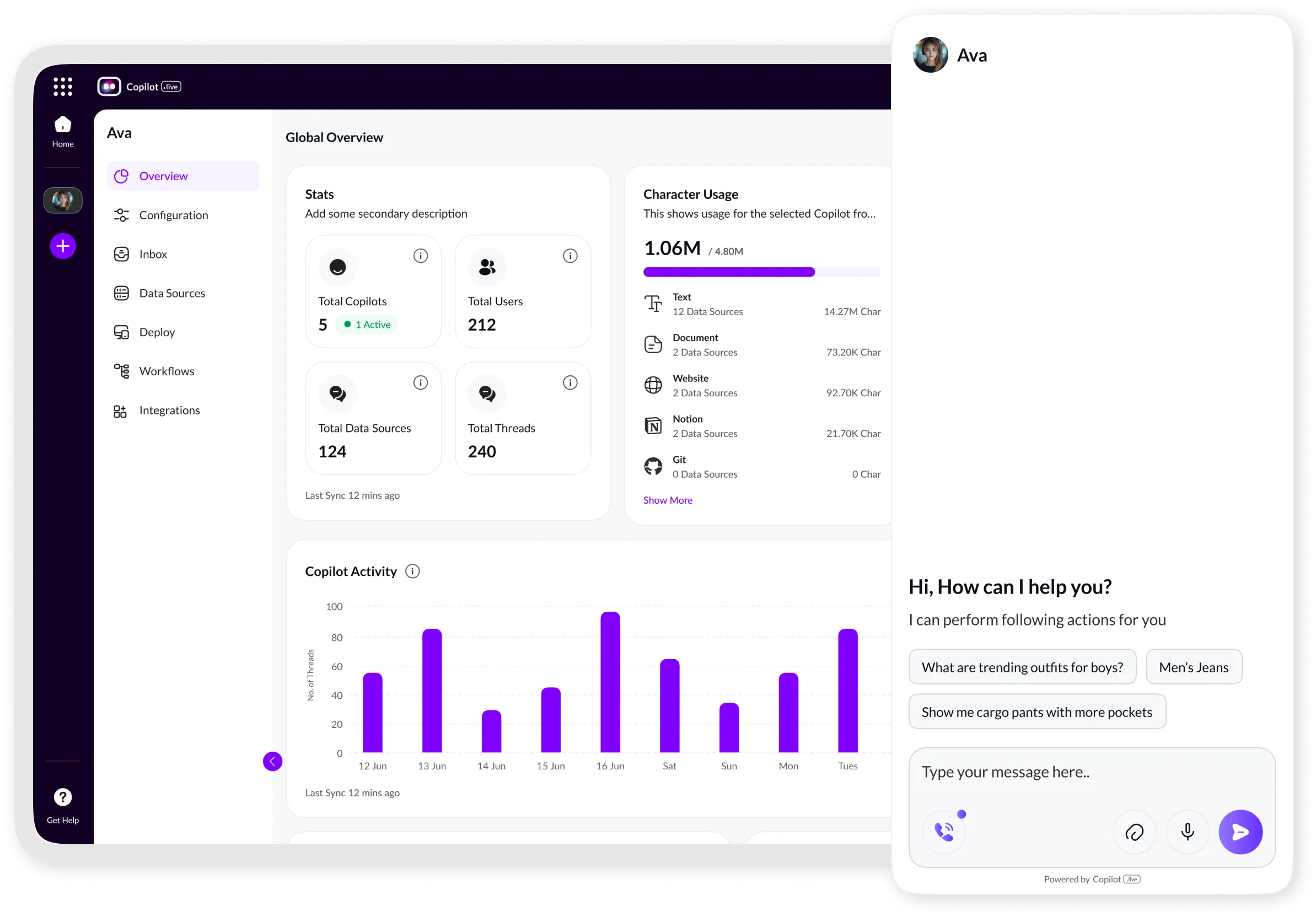

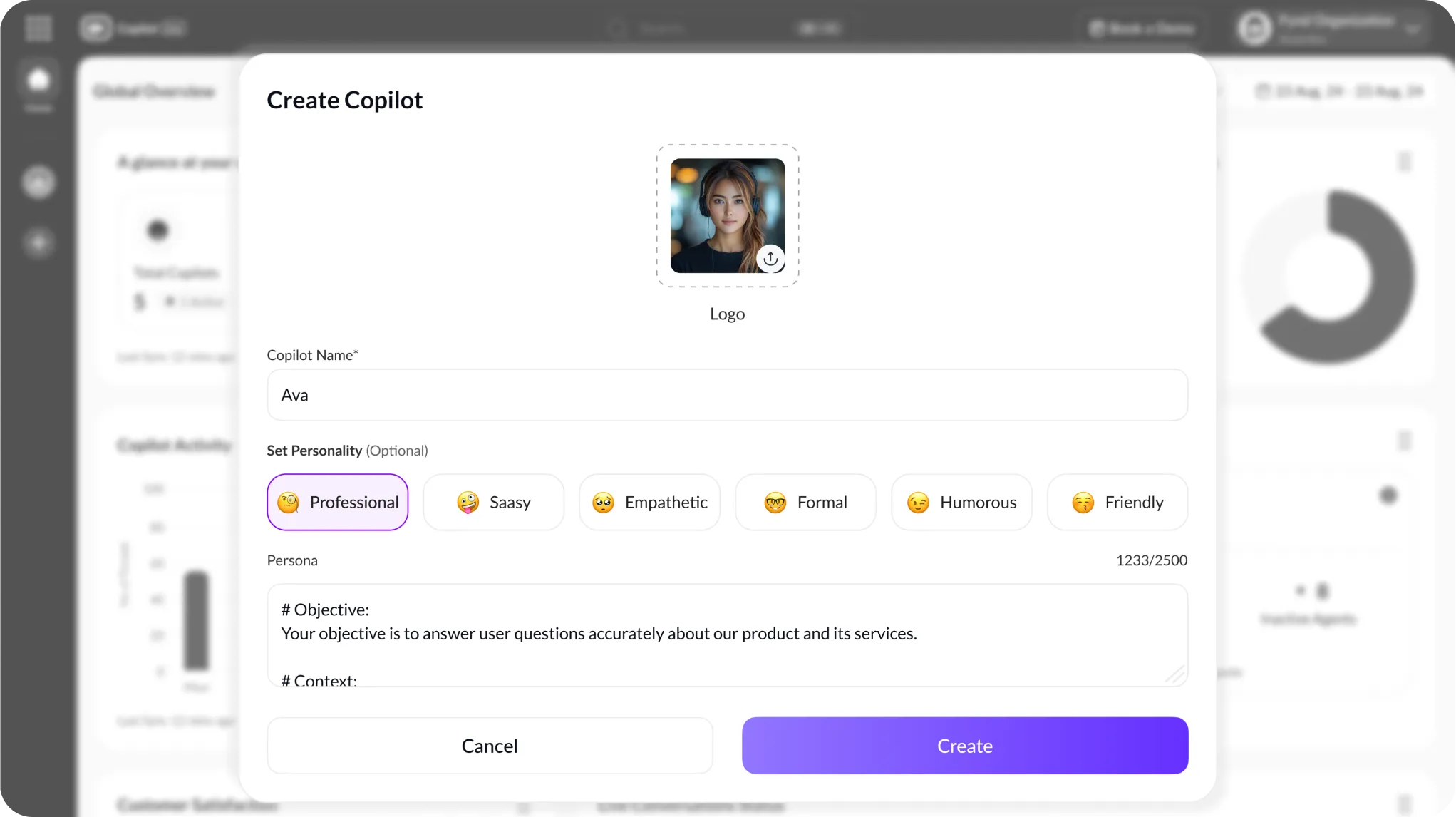

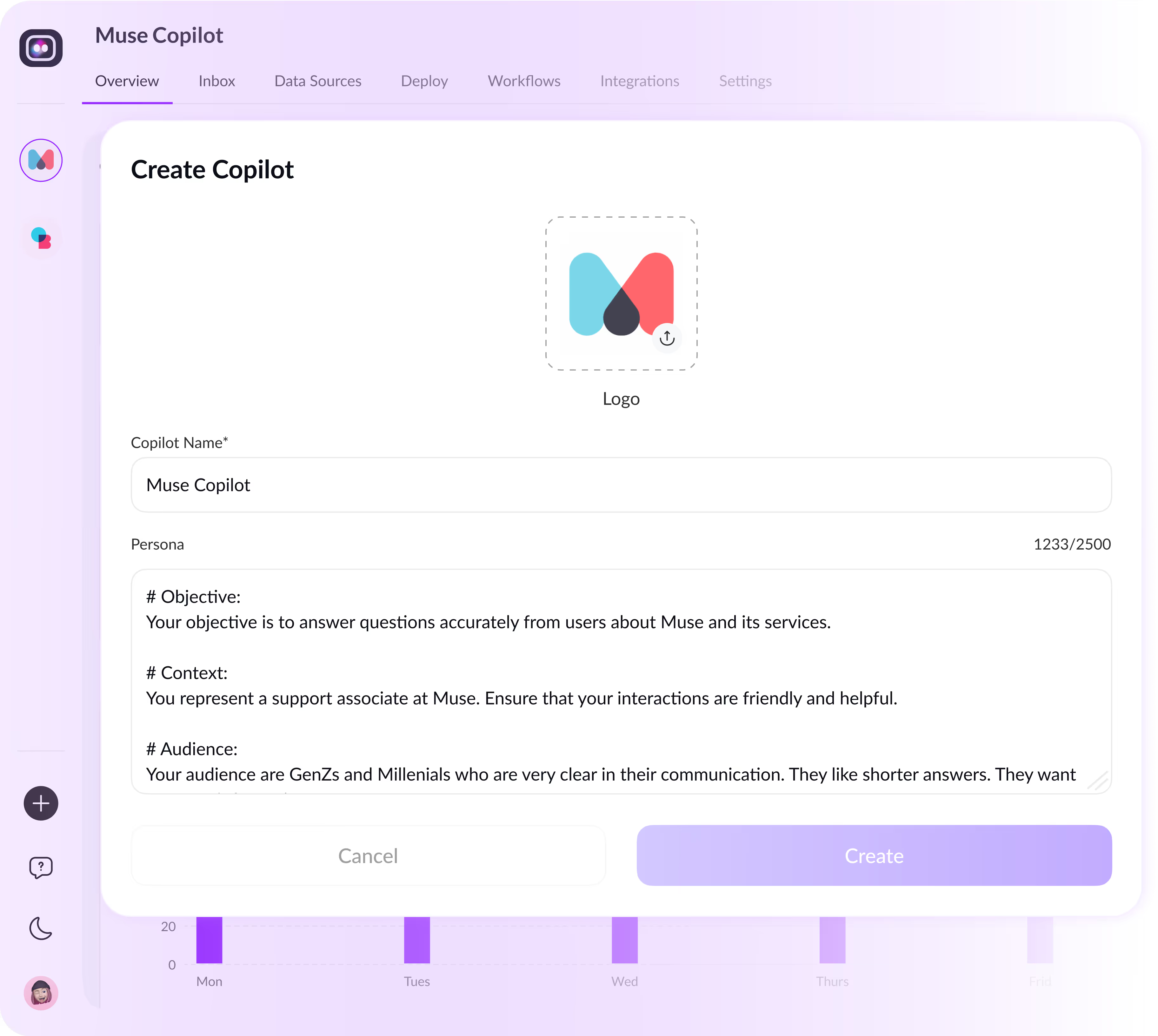

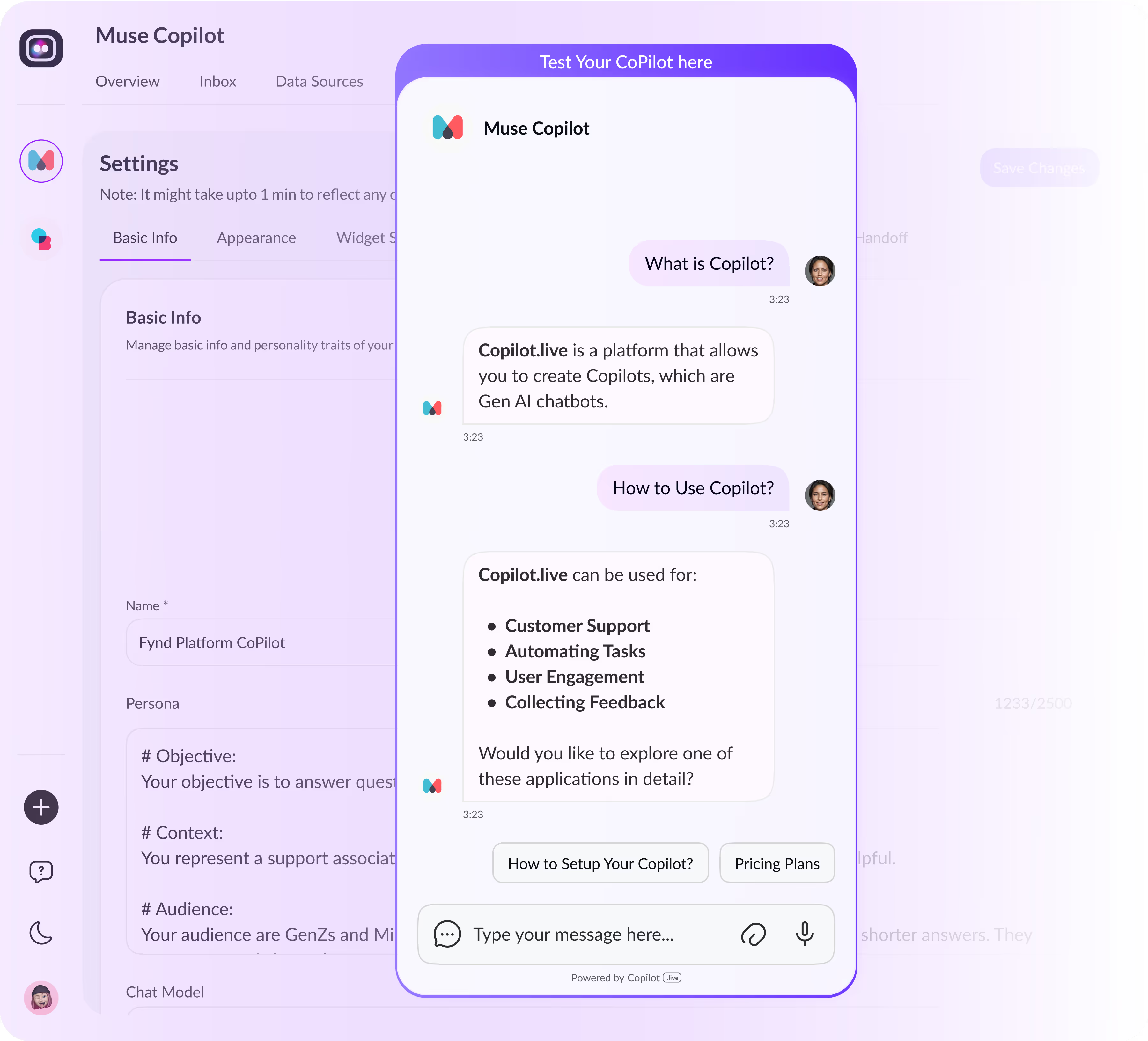

Build an AI assistant in 3 minutes

How to create a banking chatbot

Visit Copilot.live

First, go to the website. Click on the signup button to begin.

Click on Signup

Now, enter your details. This could be for a personal account or a business account. It's time to set up your chatbot.

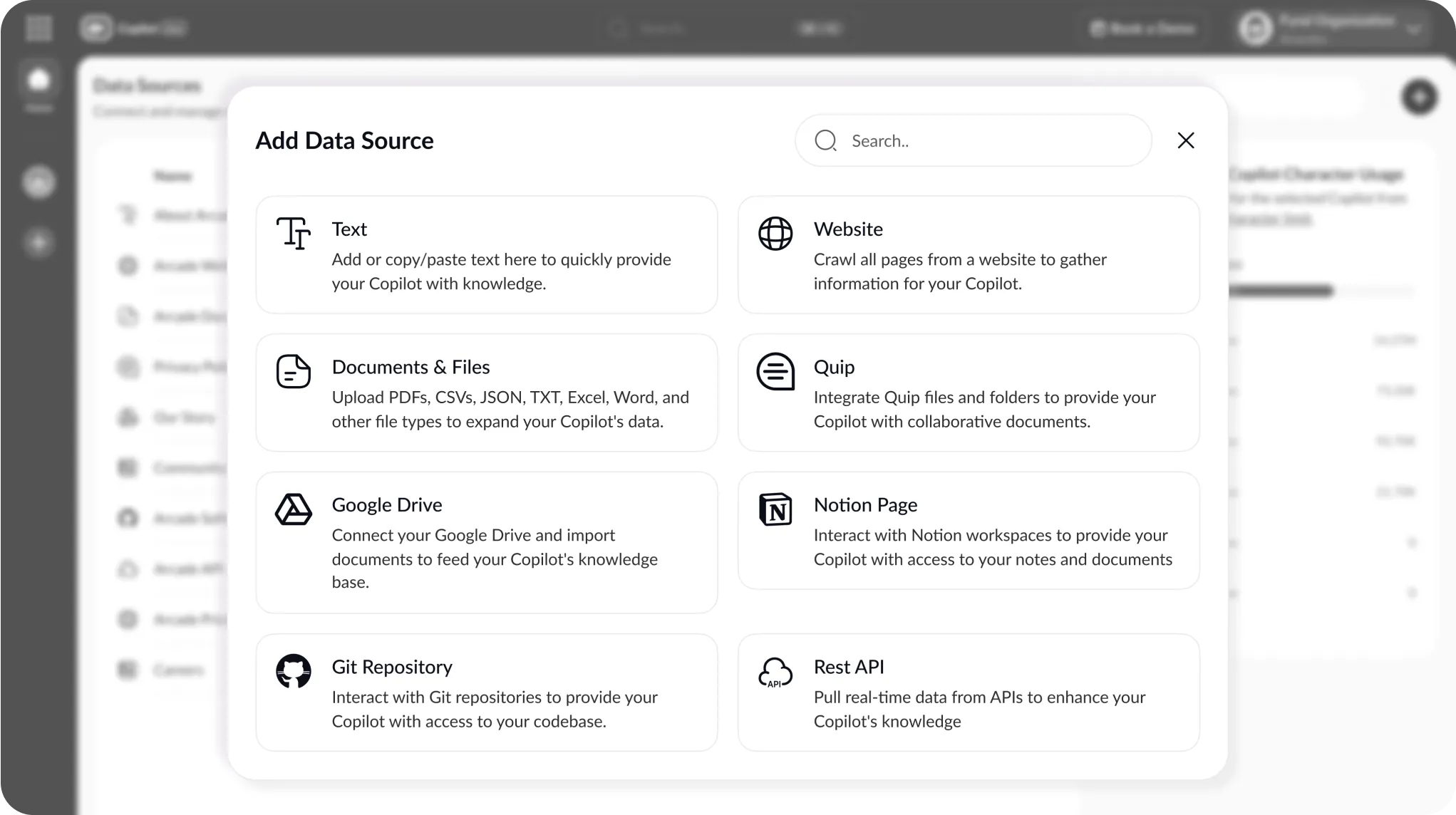

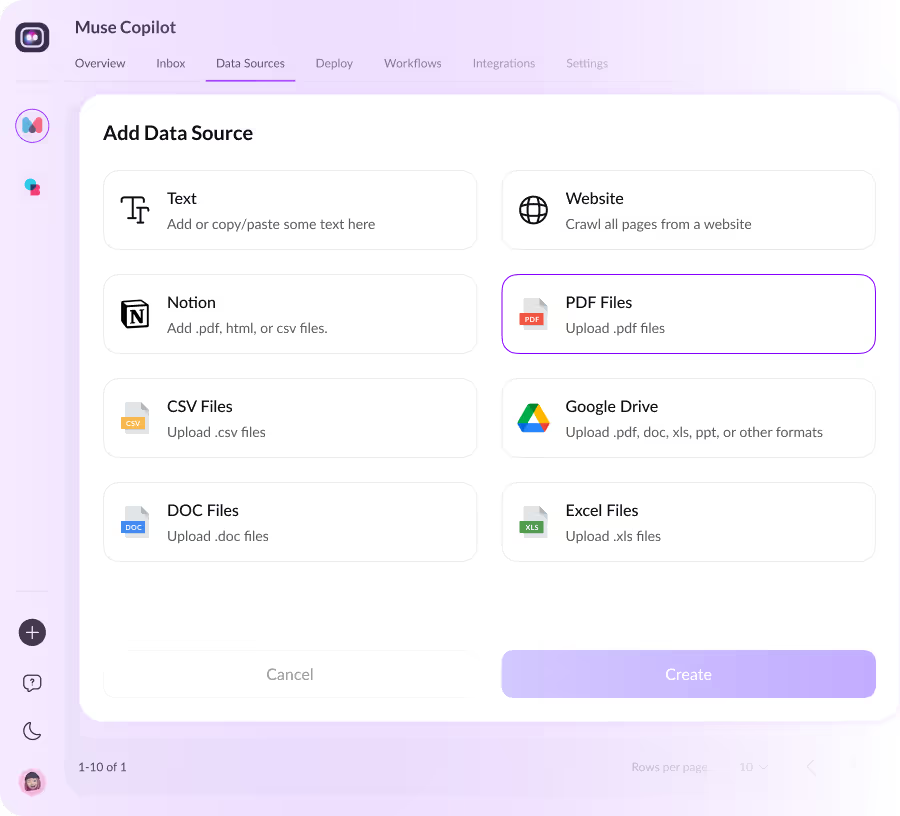

Add a Data Source

Use Copilot.live, an easy platform to build your chatbot without hassle. Add your bank or financial service URL, and Copilot.live will crawl and fetch the data.

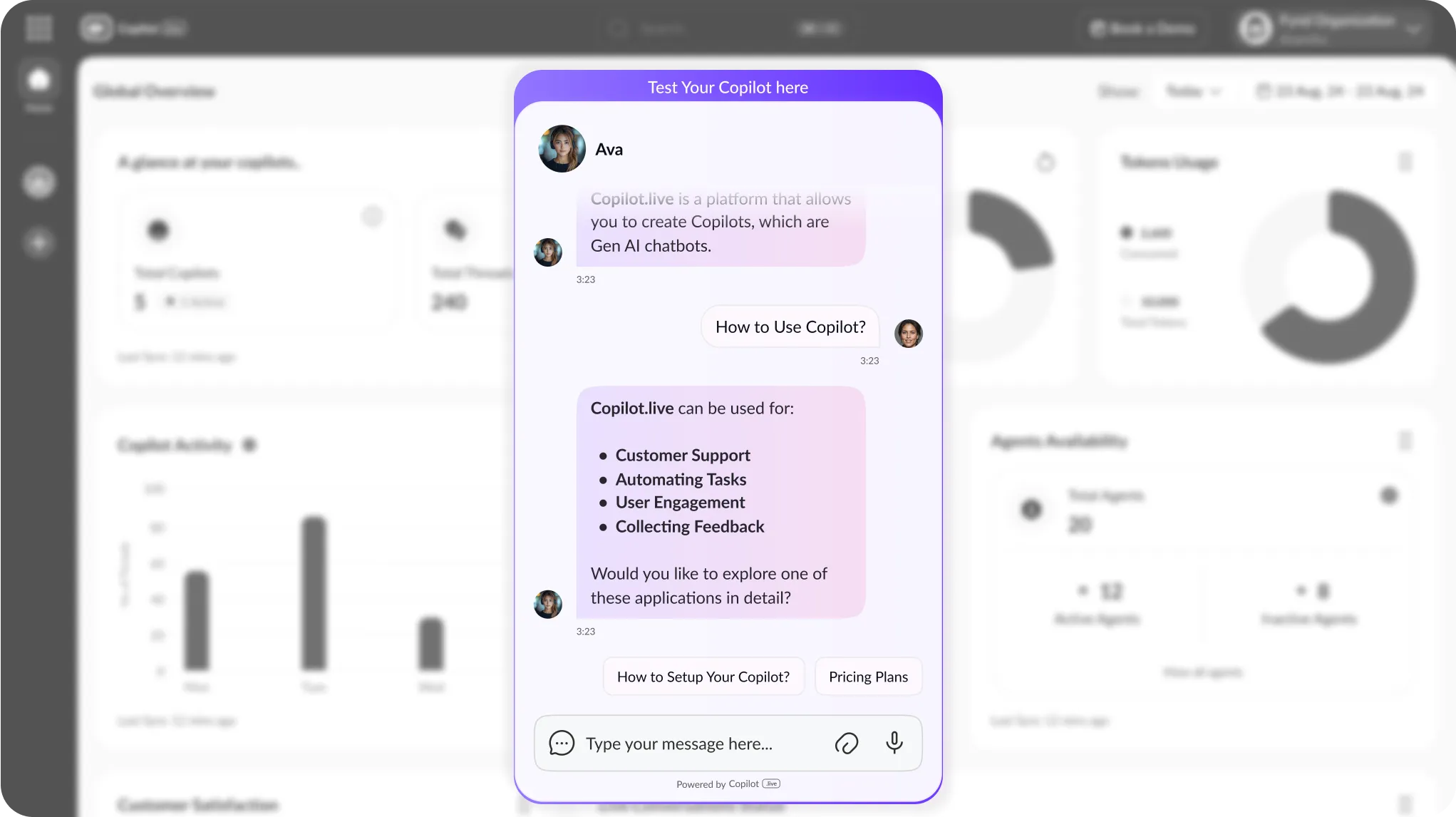

Deploy to Your Platform

Launch your chatbot across all your banking channels. This includes websites, mobile apps, and messaging services.

What is a banking chatbot?

A banking chatbot is software that transforms your banking experience with artificial intelligence. It supports customers 24/7 with a personal touch. In other words, a banking chatbot is designed to have human-like conversations with all your users and customers using natural language processing (NLP).

It uses machine learning and artificial intelligence to understand human conversation and develop the appropriate solutions. It understands the prior conversations of your bank's visitors and customers. As you have human customer support executives in your bank, the AI bank chatbot is available 24/7, which will support multiple customer queries at once and help your bank lower the cost of customer care executives.

Why do you need a Banking Chatbot for your financial services business

Better customer support

Chatbots answer questions quickly. Banking Chatbot helps customers fix issues without waiting for a human to help them. That’s super important.

Instant answers to faqs

Banking Chatbots can give your customers fast answers to common questions like “What’s my account balance?” or “Tell me about loans.” They cut down wait times and make it easier for users to access their personal information without even calling the customer care support team.

More customer engagement & sales

Banking Chatbots guide customers through services, answer their questions, and help them make smart choices with their money. This often results in more sales and happy customers.

24/7 Availability

Everyone wants help anytime, day or night. A banking chatbot is always there for your customer Account info, loan applications, etc., whenever needed. Banking Chatbots use Artificial Intelligence (AI) and its advancements in Natural Language Processing (NLP) and Large Language Models (LLMs) to give accurate answers.

Who can benefit from a banking chatbot?

Banks, financial companies, and fintech firms use chatbots to boost service quality. If your business manages loans, insurance, or investments, a chatbot can help your customers fill out applications or updates. Even digital banking services and wealth management companies can use our Banking Chatbots They’re great for booking appointments, sending reminders, and giving real-time updates. No matter your customer finance service, a banking chatbot saves time, cuts down manual tasks, and improves customer satisfaction.

Key features & benefits of banking chatbot

A banking chatbot can make your financial services work better & be more friendly. Let’s explore how it can help your business. Banking chabot will be the most important part of your business for your team as well as external customers.

Personalized Assistance

The chatbot can make special recommendations. It analyzes customers' needs and helps them choose the right banking products. Personalized assistance will help you meet the customers' expectations regarding answer quality and response time. NLP understanding and 24/7 customer support will help you meet the demands of the diverse customer base.

Faster Transactions

Customers can check balances, transfer money, or apply for loans through the chatbot. They don’t have to visit a branch at all. The chatbot will also remind the customer about their dues and upcoming payments, reducing the cost of virtual assistance. It will help the customers complete the transaction faster and make the bottom line profitable.

Cost Savings

With routine tasks handled by the chatbot, your support team has less to do. This means you save money & work more efficiently. Proactive customer support will always keep your customers in the loop, resulting in the retention of a loyal customer base. The chatbot can handle all the manual tasks of support tickets and problems without involving real human effort.

Multilingual Support

If your business serves different customers, your chatbot will communicate in multiple languages, ensuring every customer gets help in their preferred language. Offering various languages in banking support will give you a great advantage. This will also allow your banking services to reach global and regional customers.

Banking chatbot use cases in various industries

Retail Banking

Chatbots can help banks. Customers can check their account balances, send money, and get quick answers about their accounts. It makes banking easy and fast every day. No more waiting in long lines or being on hold. It helps with customer support and engagement. With banking chatbots, you can handle routine inquiries, check your account balance, review transaction history, and get answers to frequently asked questions all in one place. This automation upscales your banking experience by providing quicker and faster service.

Insurance

Insurance firms also found chatbots to be helpful. Your customers may view policy details, submit claims, and get answers to their inquiries about coverage with the help of a banking chatbot. This implies that your clients can get assistance at any time. With an insurance chatbot, your customers can easily manage their accounts by transferring funds between policies, opening new accounts, closing existing ones, and requesting account statements.

Management of Wealth

Banking chatbots share market trends, provide portfolio updates, and offer investment advice to your clients. They also assist in scheduling consultations with financial advisors, making managing wealth quicker and easier. Chatbots can assist your customers in wealth management by offering investment advice, portfolio insights, stock market inquiries, and retirement planning guidance.

Loan Services

Banks and lending firms use chatbots to assist people applying for loans. They can check the customer status of a loan and ask about interest rates, too. This speeds up the process and helps customers get answers fast. Chatbots assist with applications, calculate eligibility, provide interest rate information, and guide credit score improvement in loan and credit services.

Online shopping

Banking chatbots benefit customers in e-commerce. They help customers track payments or transactions, handle refunds, and pay invoices. This ensures hassle-free purchases and refunds, streamlining the buying experience.

Real Estate

Real estate agents & companies can also use chatbots! They help clients with mortgage inquiries and property financing questions, & guide them through home loan applications. This allows clients to find financial solutions quickly.

Healthcare

In healthcare, a banking chatbot can help patients pay medical bills, see if their insurance covers something, and get updates on outstanding payments. It can also send reminders for co-pays or medical payments. In healthcare, healthcare chatbots can ask all hidden and customized questions. Your customers can ask about every detail of hospital billing, giving complete transparency in customer relations.

Travel & Hospitality

Travel agencies and airlines can use chatbots to help customers pay for bookings, check travel insurance details, & fix payment problems during trips. This ensures smooth financial transactions while traveling. All travel and hospitality industry portals and hotels should have a travel and hospitality finance chatbot to help with transactions, checks, and invoices.

Best Practices for a Successful Banking Chatbot

Banking chatbots help the banking sector; they must be tested before deployment. Make it simple and friendly, using clear words so your customers can understand. Plus, it should quickly answer common questions like checking balances or asking about loans. Banking Chatbot is always available for your customers, 24/7, so your customers can get help whenever they need it. Keep making your chatbot better, too! So the Copilot.live can help collect data from your customers about what they say and update it to stay smart, safe, and useful.

Frequently Asked Questions

You can reach out to us in case of any queries, feedback, or suggestions via [email protected] or read below.

A. A financial chatbot uses AI to handle questions & answers. It helps understand what clients are asking and gives useful replies like a person would.

A. They have strong security features that keep your customers' data safe.

A. Yes, Safety is key. Banking chatbots keep your info secure using encryption.

A. Yes, Smart chatbots use AI to analyze your information. Banking chatbots can suggest financial services and products based on customer preferences.

A. You can connect them via Phone apps, bank websites, smartphone apps, etc.

A. Banking chatbots are made to reply quickly. They help cut down times compared to regular support, like phone calls or emails.

A. Yes, these chatbots are available for your customers 24/7. You can reach out anytime for help with transactions, account questions, or other banking requirements.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)